Summary

The purpose of this study was to evaluate current demographics and trends within the Pennsylvania dairy farm community, as well as study the impacts 2020 and the COVID-19 pandemic may have had on the dairy farm community. The survey covered questions within four different categories: farm demographics, impacts of the pandemic, farm management practices, and cooperative and milk marketer related questions. More than 5,000 surveys were mailed to Pennsylvania dairy farms in June 2020. Farms could complete the survey online or mail a completed survey back to the Center for Dairy Excellence. The deadline to submit surveys was July 31, 2020.

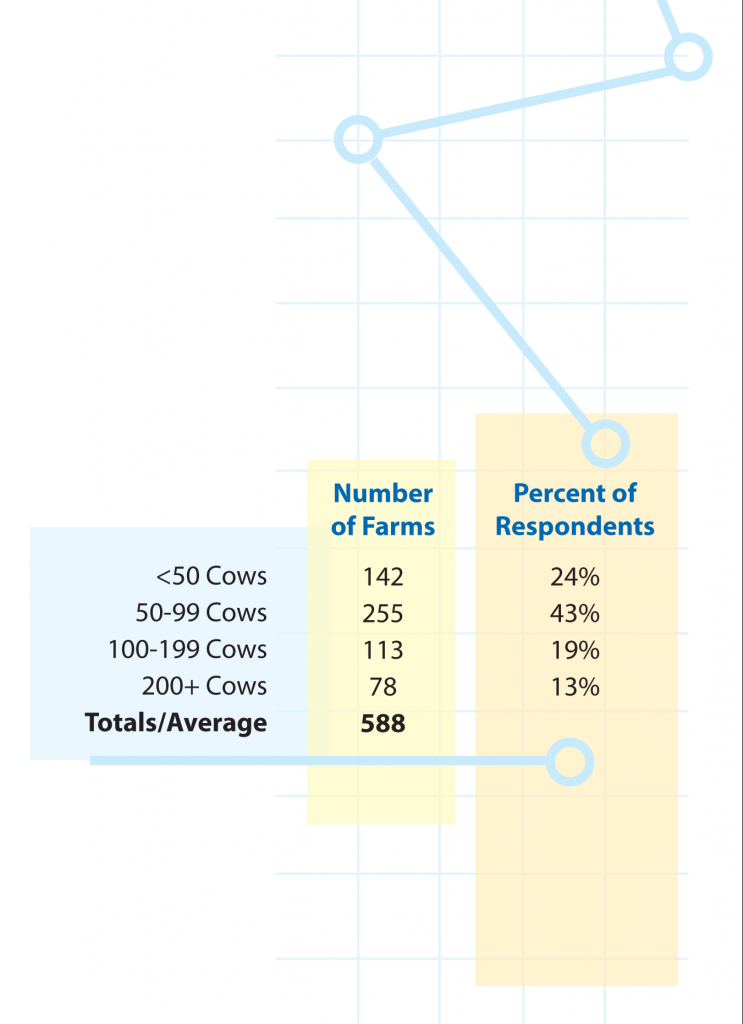

In conjunction with the Pennsylvania State University Smeal College of Business, the Center received completed surveys from 711 farms, with 83 percent (or 588 farms) being in business at the time of completing the survey and 17 percent (or 123 farms) indicating they had exited the business prior to completing the survey.

Click here to download a detailed report with explanations and analyses of survey results.

Watch our webinar highlighting survey data:

Listen to our podcast highlighting survey data:

View charts and figures:

Introduction

The survey consisted of 27 questions in four categories:

1. Owner and herd demographics

2. Impact of COVID-19 and likeliness of remaining in the dairy business

3. Farm management practices used or planned to use

4. Cooperative or milk marketer related questions.

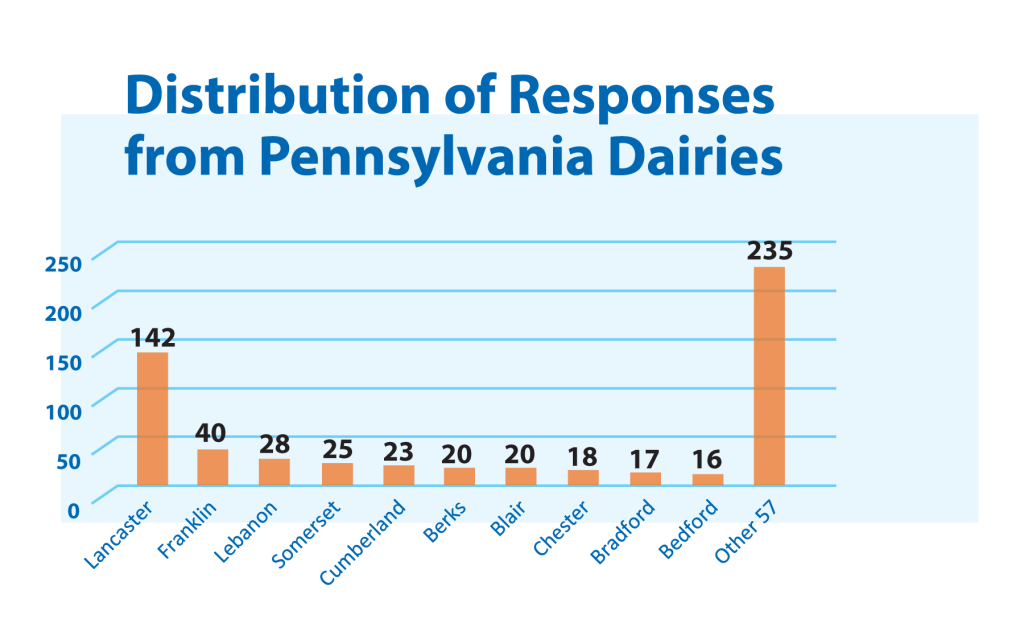

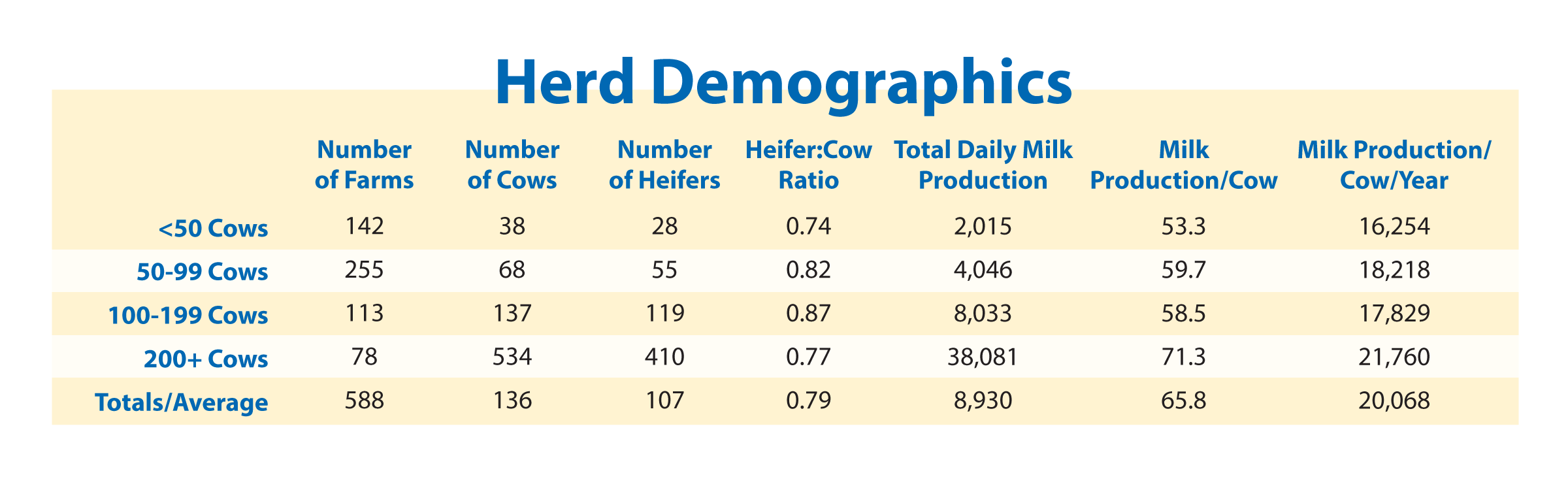

Dairy farmers were given the opportunity to fill out the survey online or to complete the mailed copy and return it. There were 711 surveys completed. Of the completed surveys received, 123 indicated they were no longer milking cows, representing 17% of total completed surveys. The remaining 588 were still in business at the time of the survey. According to the USDA, 2020 began with 5,730 licensed dairies in Pennsylvania. These 588 dairies represent 10% of Pennsylvania’s total dairies and 4% of annual milk production. Herd size was broken down into four categories, <50, 50-99, 100-199, and 200+.

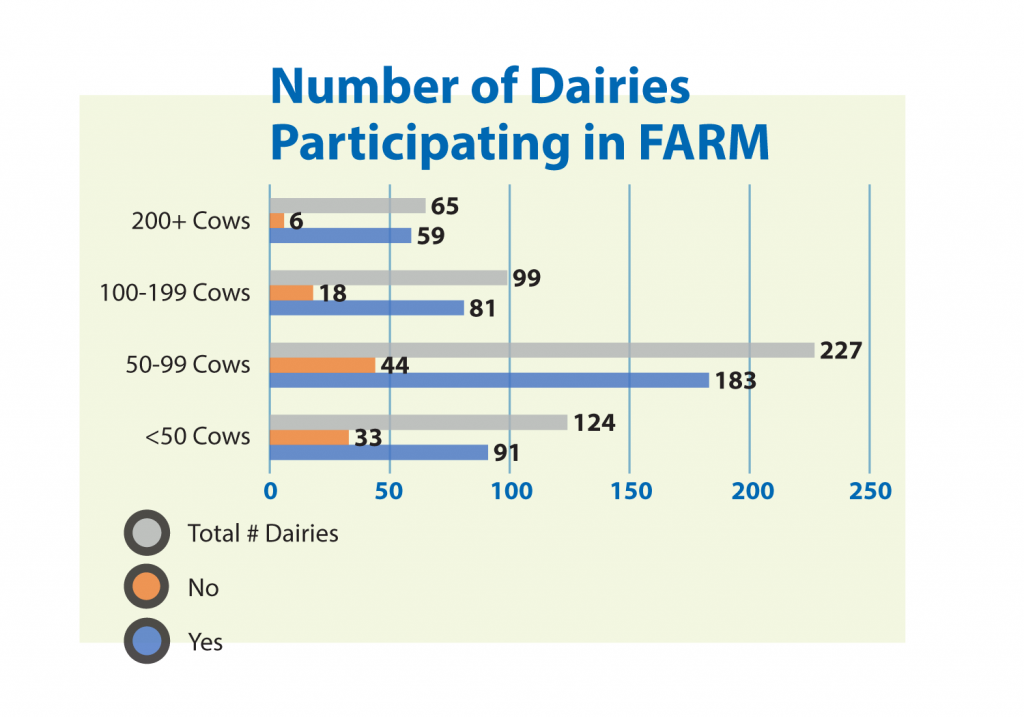

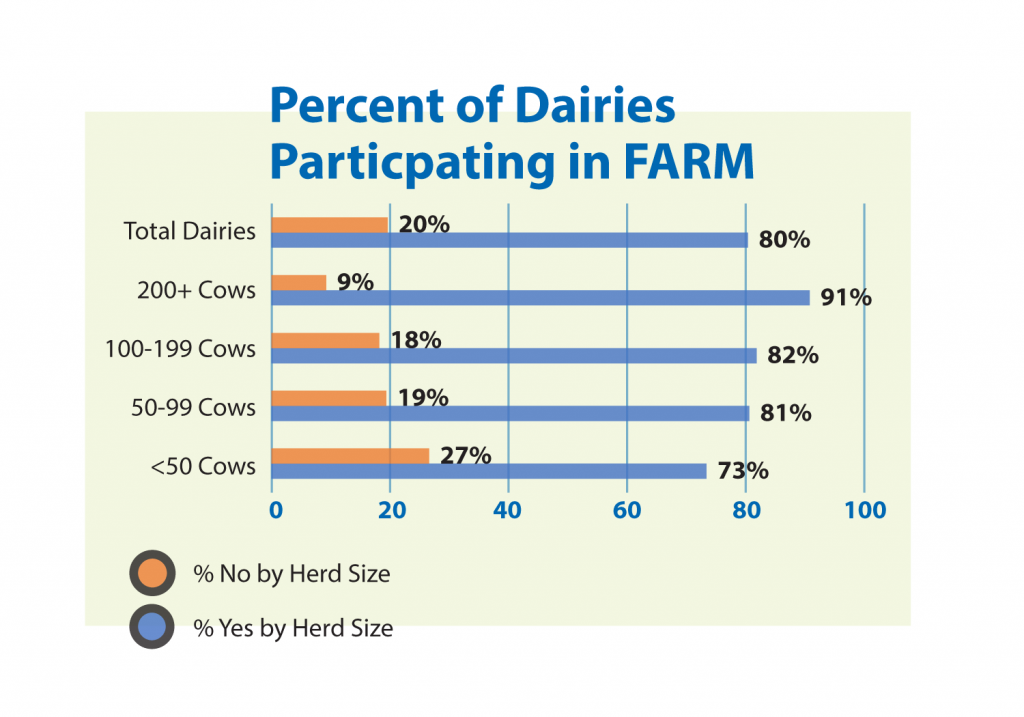

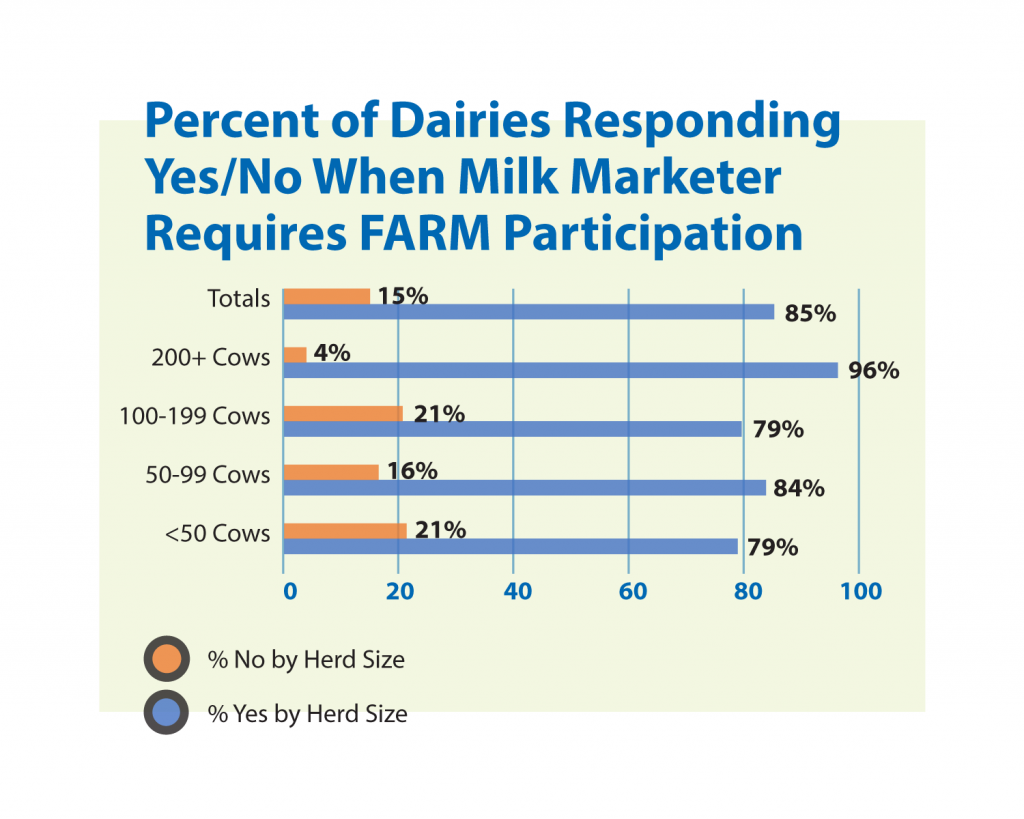

Cooperatives and FARM

Dairy farmers were asked to provide their milk marketer and whether they participated in the National Farmers Assuring Responsible Management (FARM) Program. Survey responses represent 42 different cooperatives or milk marketers. Additional farms indicated that they market their own milk or finished dairy products.

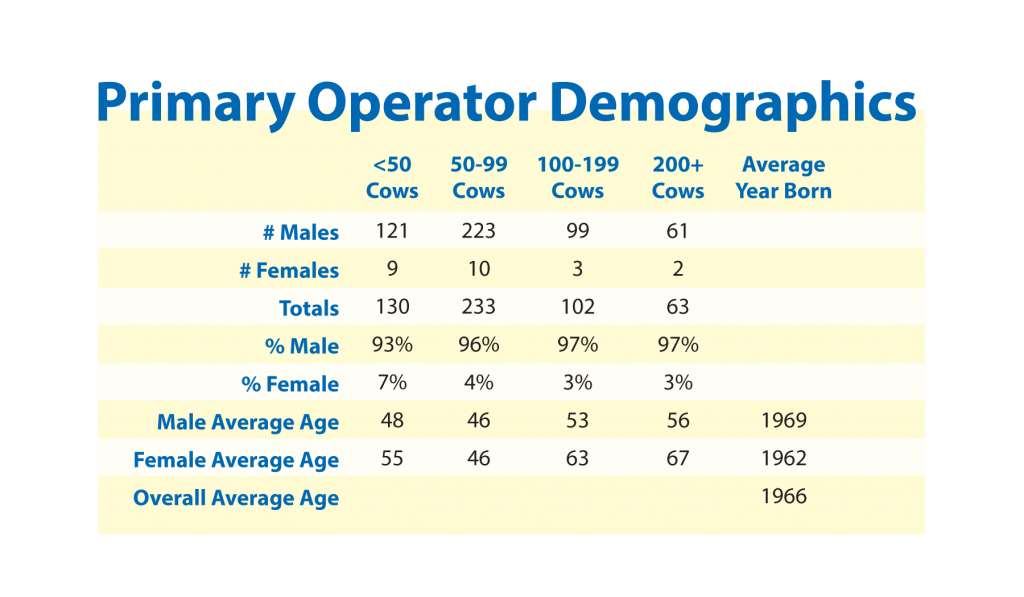

Primary Operator Demographics

The average primary operator was born in 1966 and average age is 54 years. Women accounted for 5% of the primary operators.

Herd Demographics

The size of dairies reported by the respondents ranged from four cows up to 3,000 cows. The average herd size was 136 cows producing 65.8 pounds per day or 20,068 pounds per cow annually, assuming a 305-day lactation period per cow per year. The average respondent’s cows produce 561 pounds less milk than the 2019 state average of 20,629 pounds per cow and 3,323 pounds less than the 23,391 per cow national average.

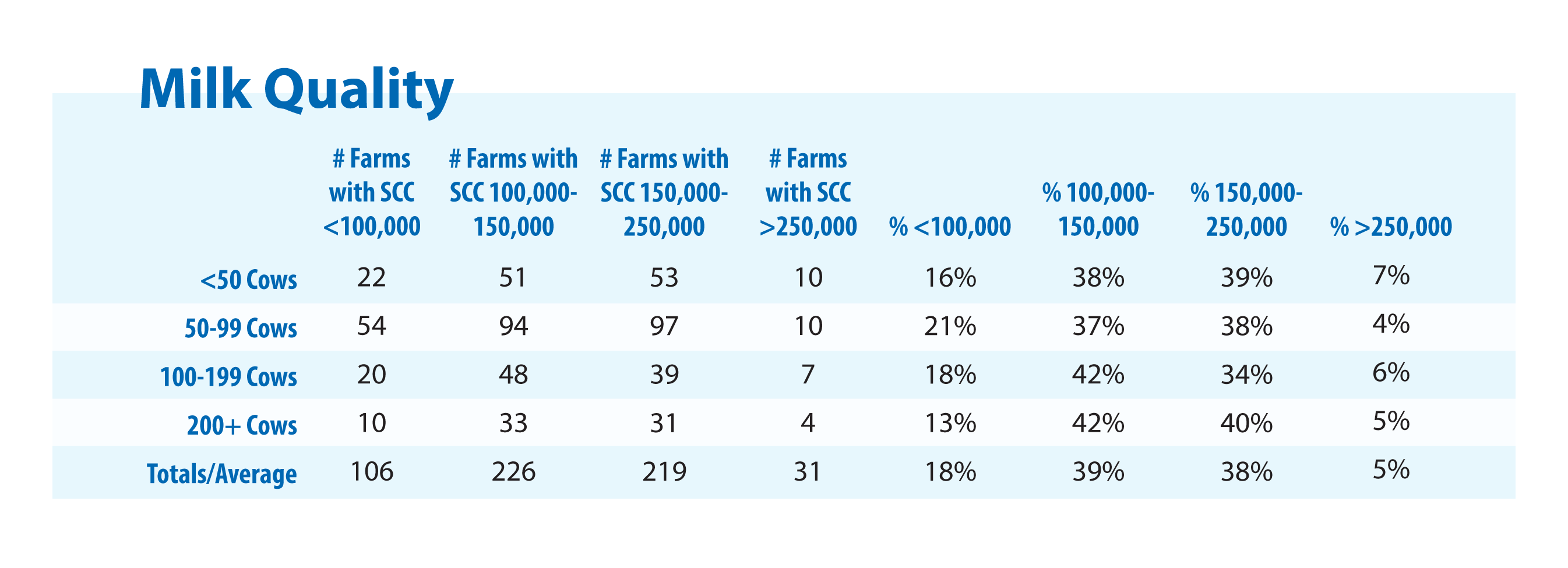

Milk Quality

The only milk quality question asked on the 2020 survey was to indicate the average range of annual somatic cell count (SCC). SCC is a count of white blood cells (measured in cells per mL) in the milk, and the higher the SCC, the more likely a cow has mastitis.

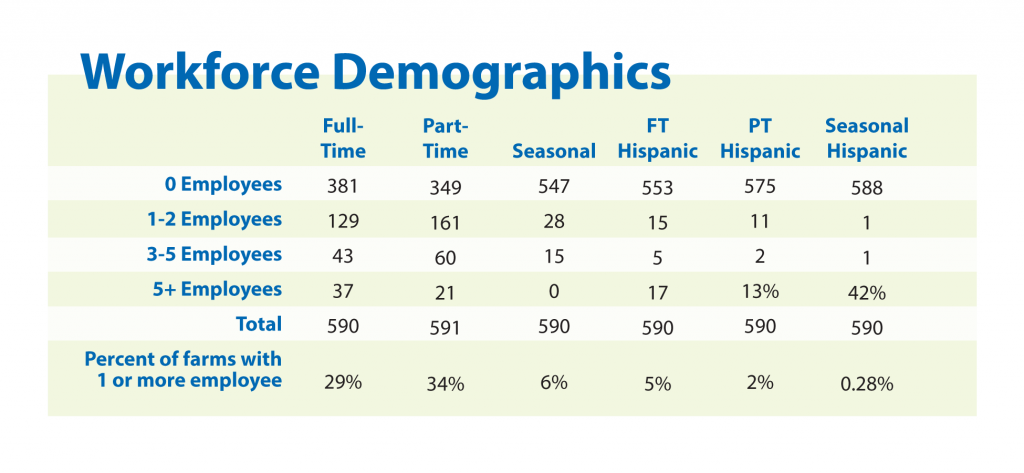

Workforce Demographics

Three questions on the survey addressed the workforce of Pennsylvania dairy farmers. The questions were:

1. How many workers does you farm employ?

2. How many workers are full-time (FT), part-time (PT), seasonal, FT Hispanic, PT Hispanic, or seasonal Hispanic?

3. What language is used for communication with your employees?

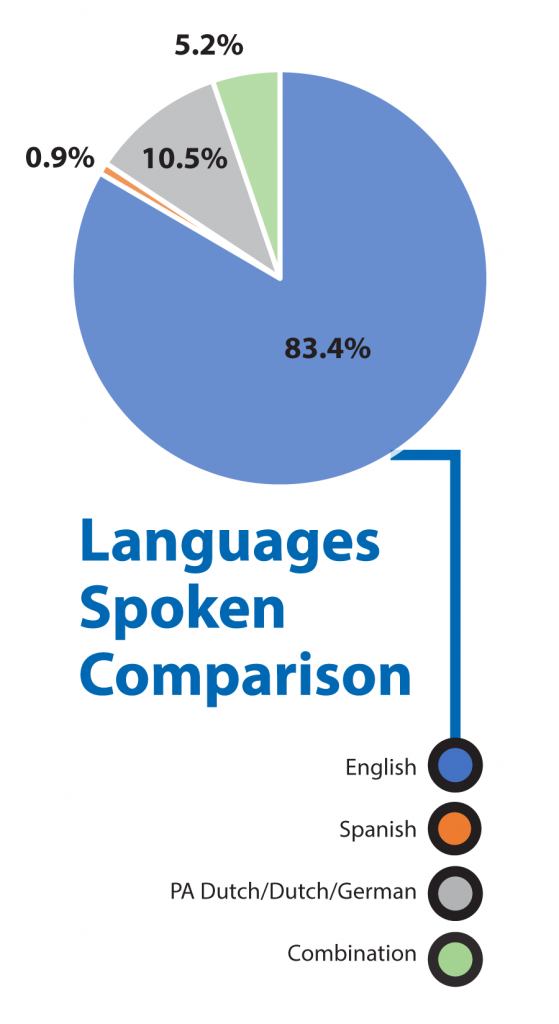

Keep in mind when reviewing the table that respondents could have employees in multiple categories or may not have answered the question. The predominant language spoken on dairy farms as indicated by this survey is English; 306 dairies reported English as the language used to communicate, representing 88% of the responses.

Financial Information

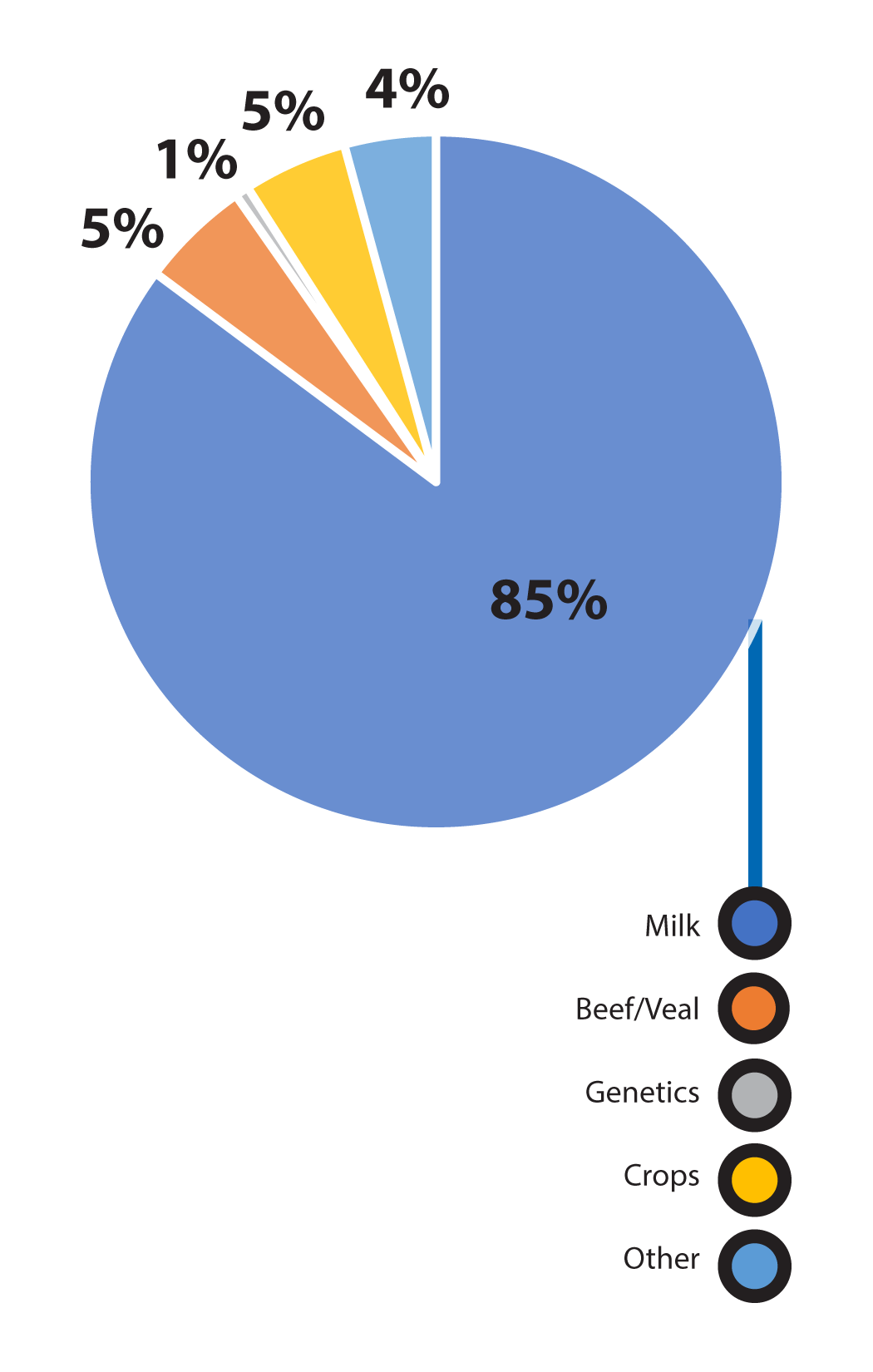

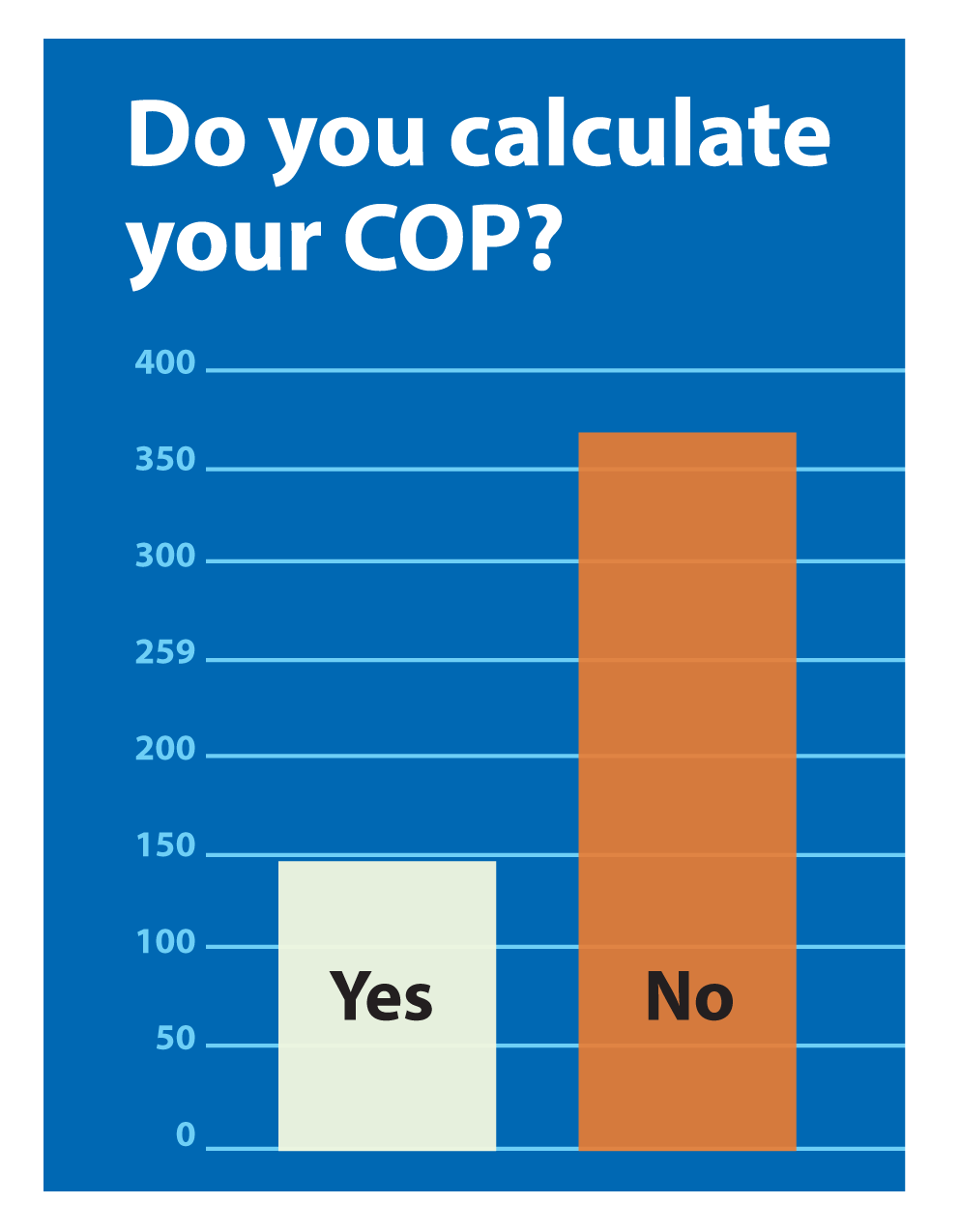

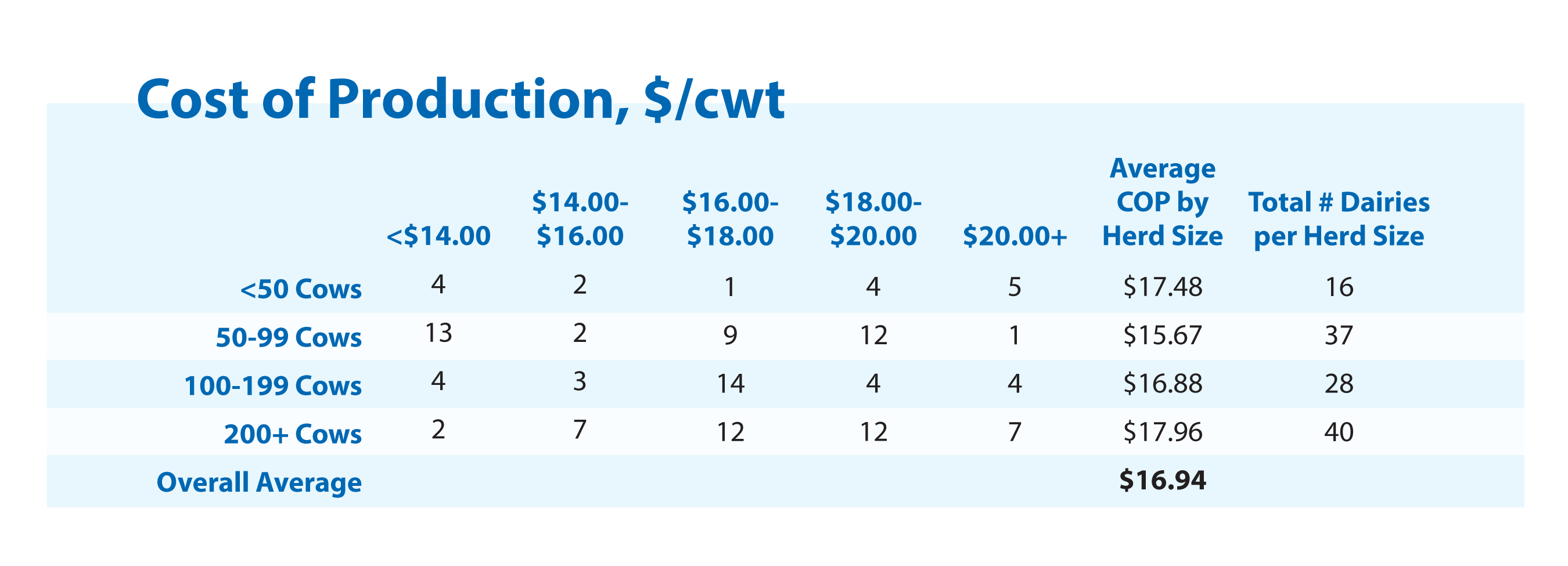

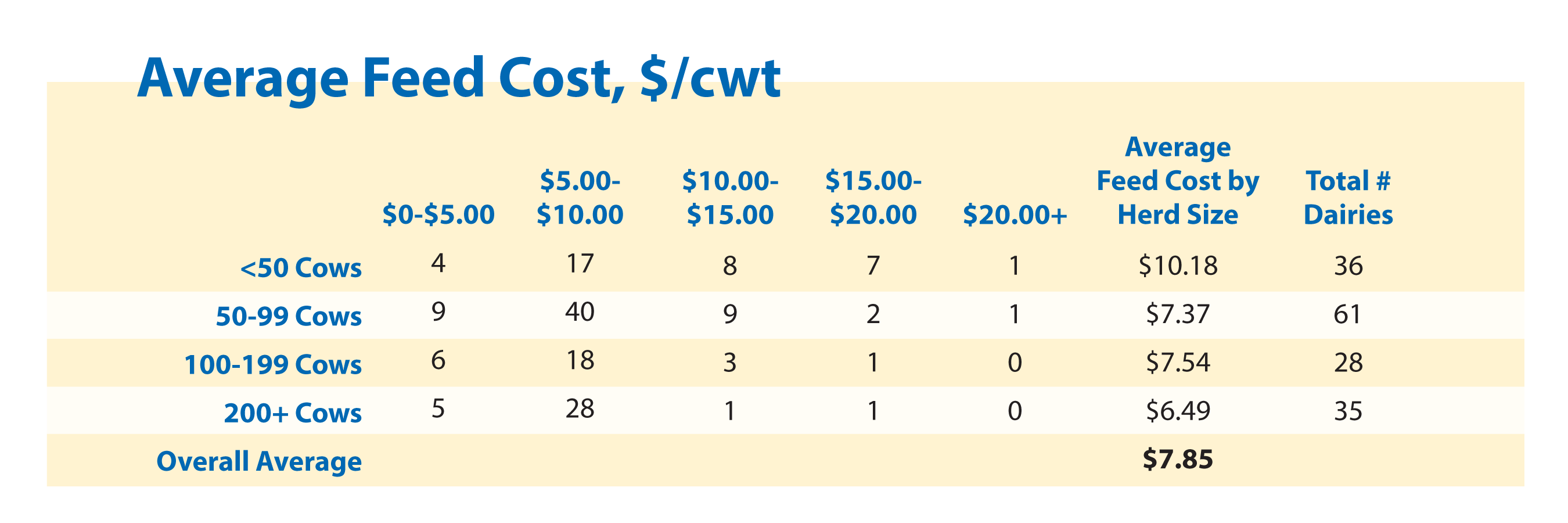

Dairies in business at the time of the survey reported that they derived 85% of their income from milk sales. In an attempt to assess the financial stability of Pennsylvania dairy farms, the survey asked a few financial related questions. Unfortunately, very few responded to these questions. With 121 surveys reporting cost of production (COP) and 161 surveys reporting average feed costs, there was enough data to list averages. However, these numbers are for information purposes only and do not represent a large enough sample size to make inferences for the entire state.

Impact of COVID-19 on Pennsylvania Dairies

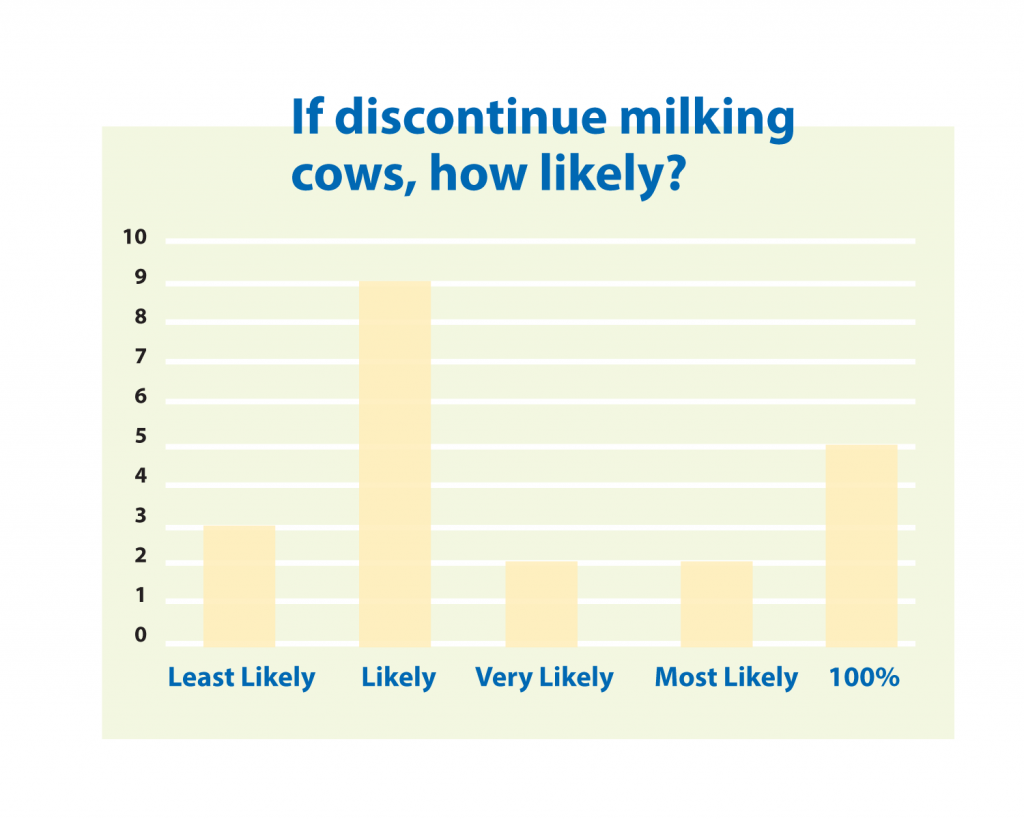

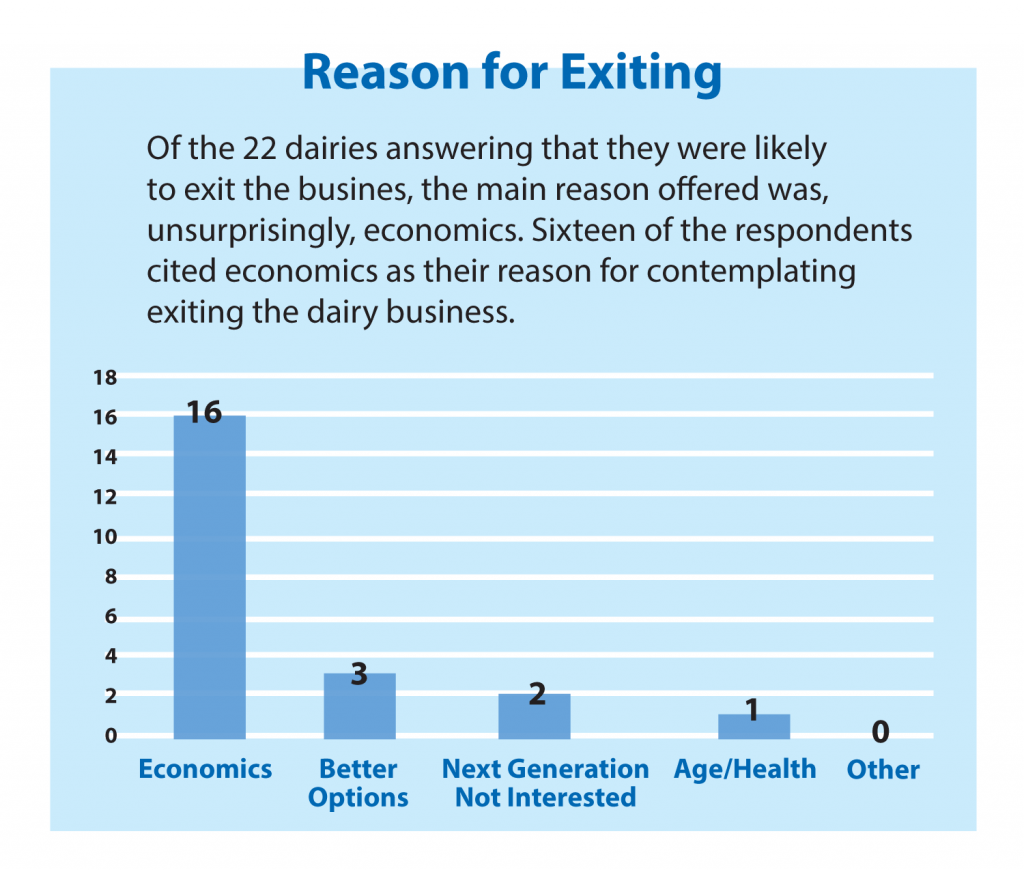

The middle section of the survey was designed to address the impact of COVID-19 on the Commonwealth’s dairy industry as of June 2020. Dairy farmers were asked if they expected to be milking cows in the next three to six months because of the market disruptions caused by COVID-19. If the respondent answered that they expected to discontinue milking cows, they were asked a series of follow-up questions to ascertain how likely they were to exit the dairy business and the reason why they anticipated they would exit. Of 531 surveys providing answers to this question, only 22 answered that they were likely to exit the dairy business in the next three to six months.

Compensation for Dumped Milk/CFAP Direct Payments

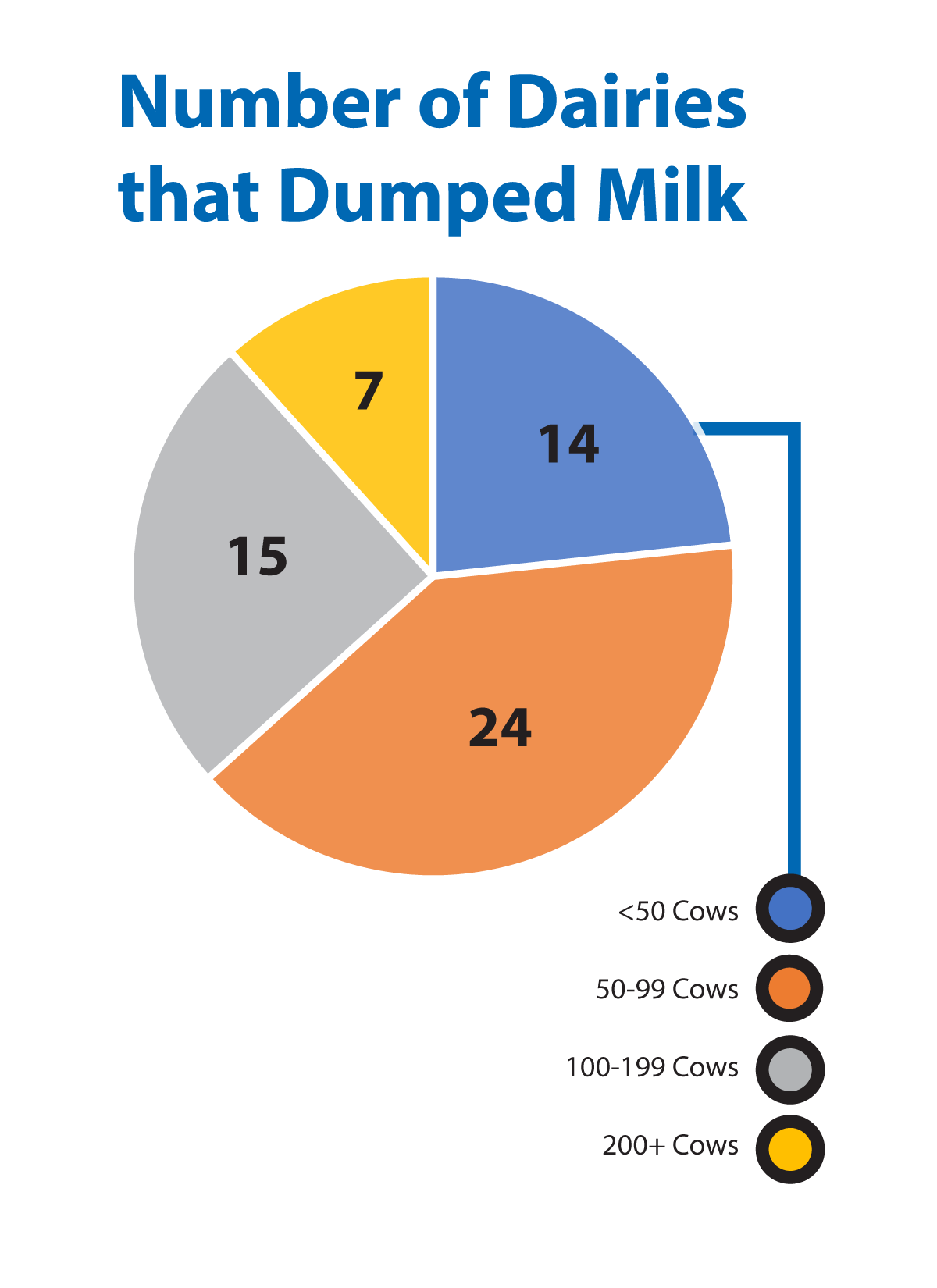

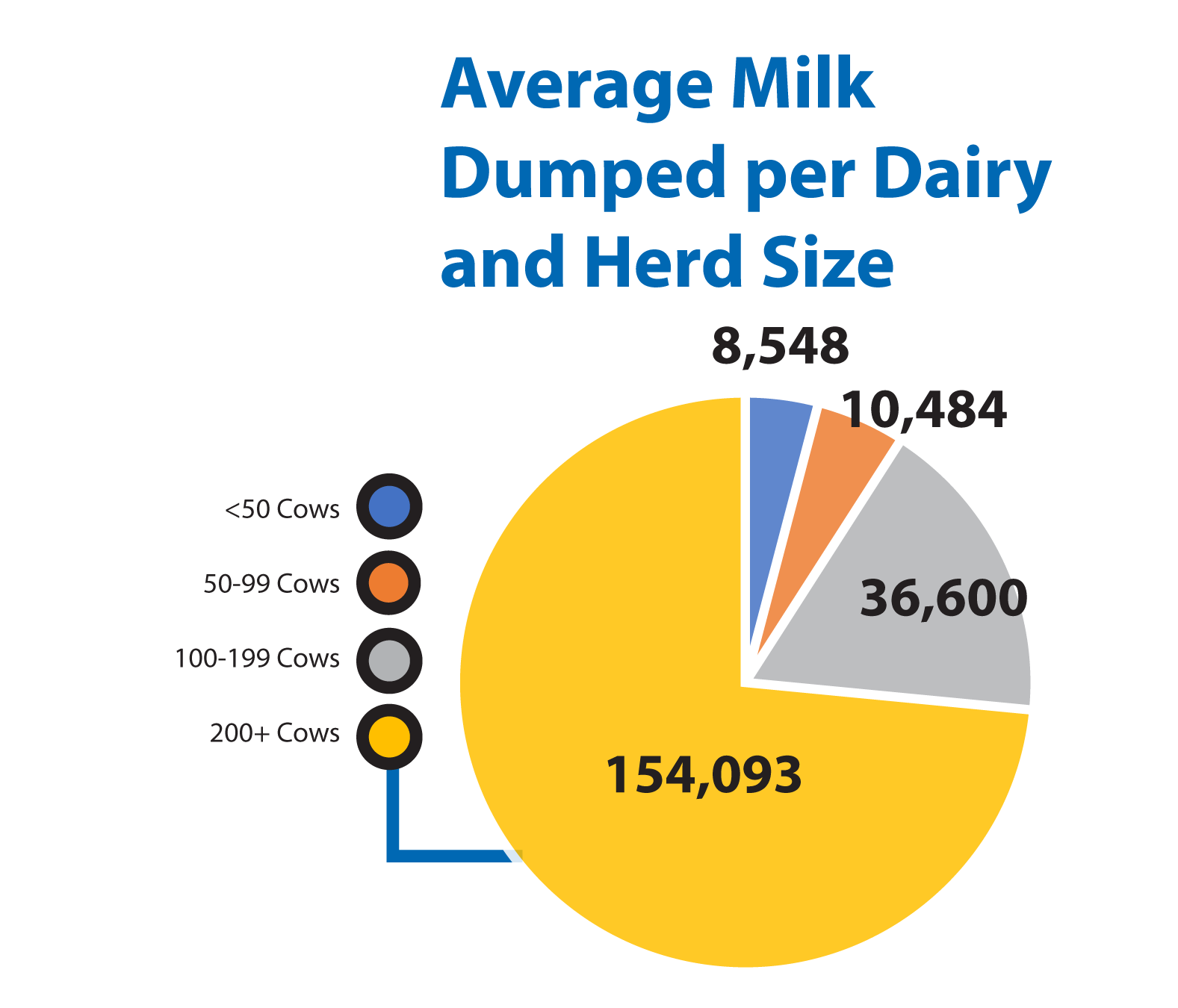

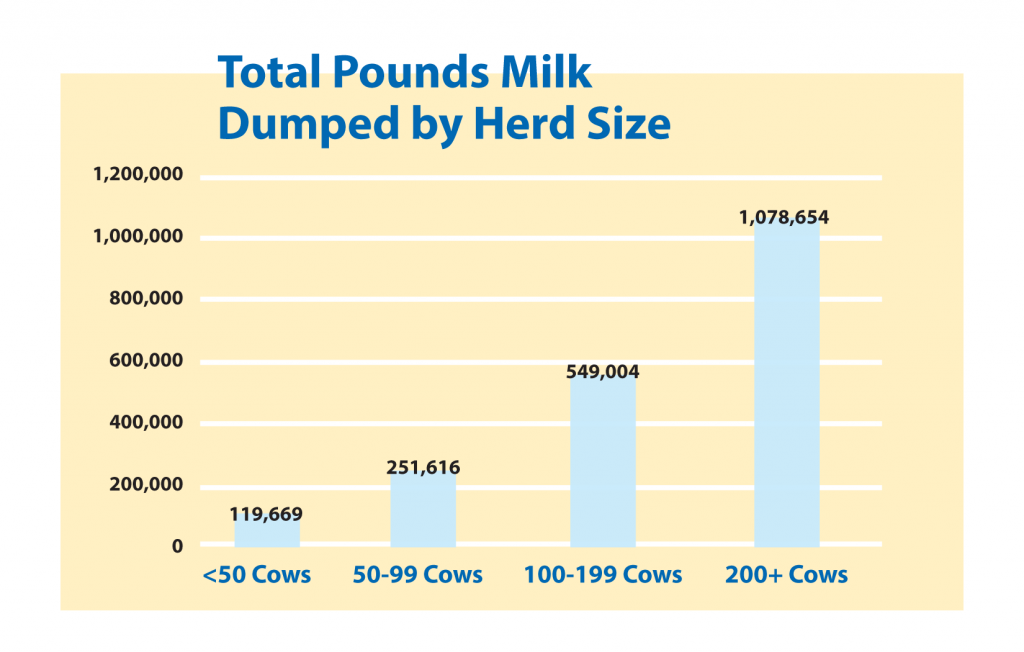

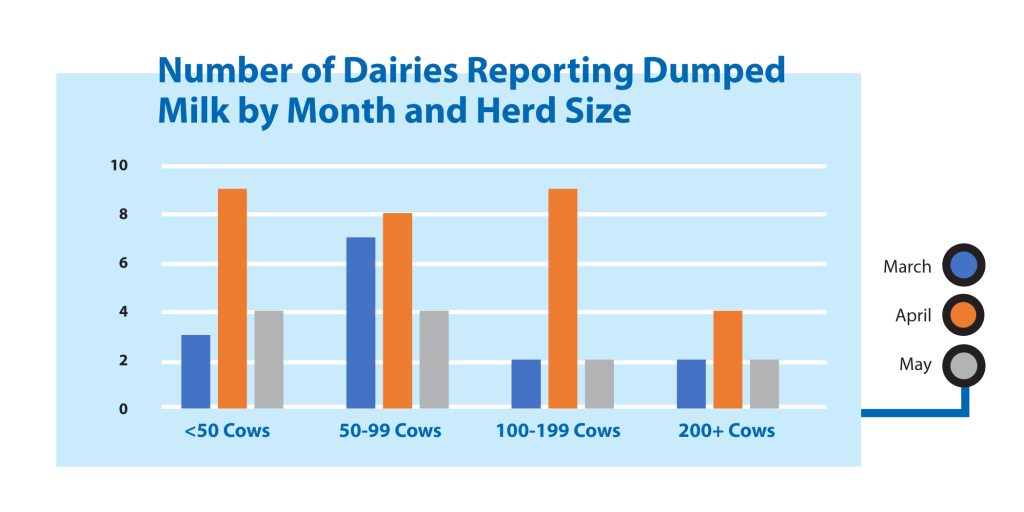

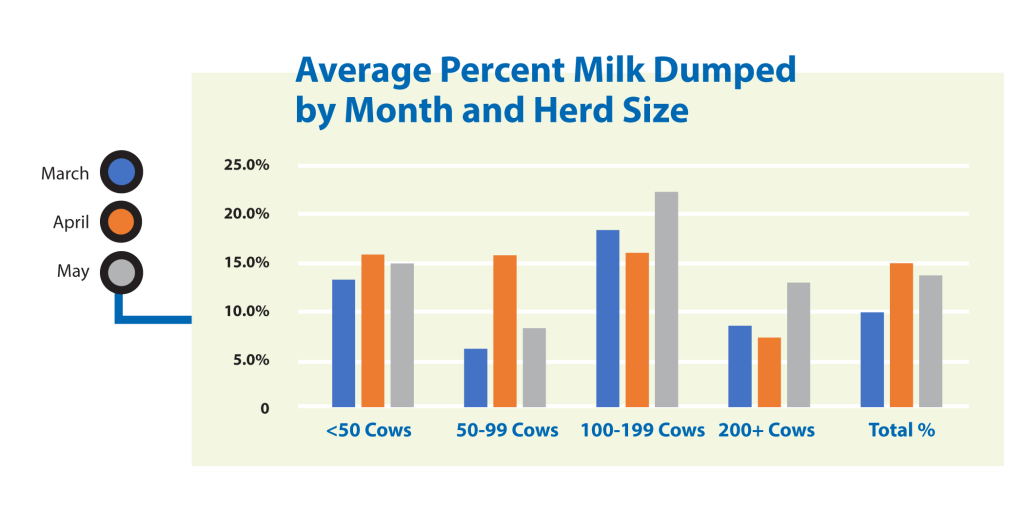

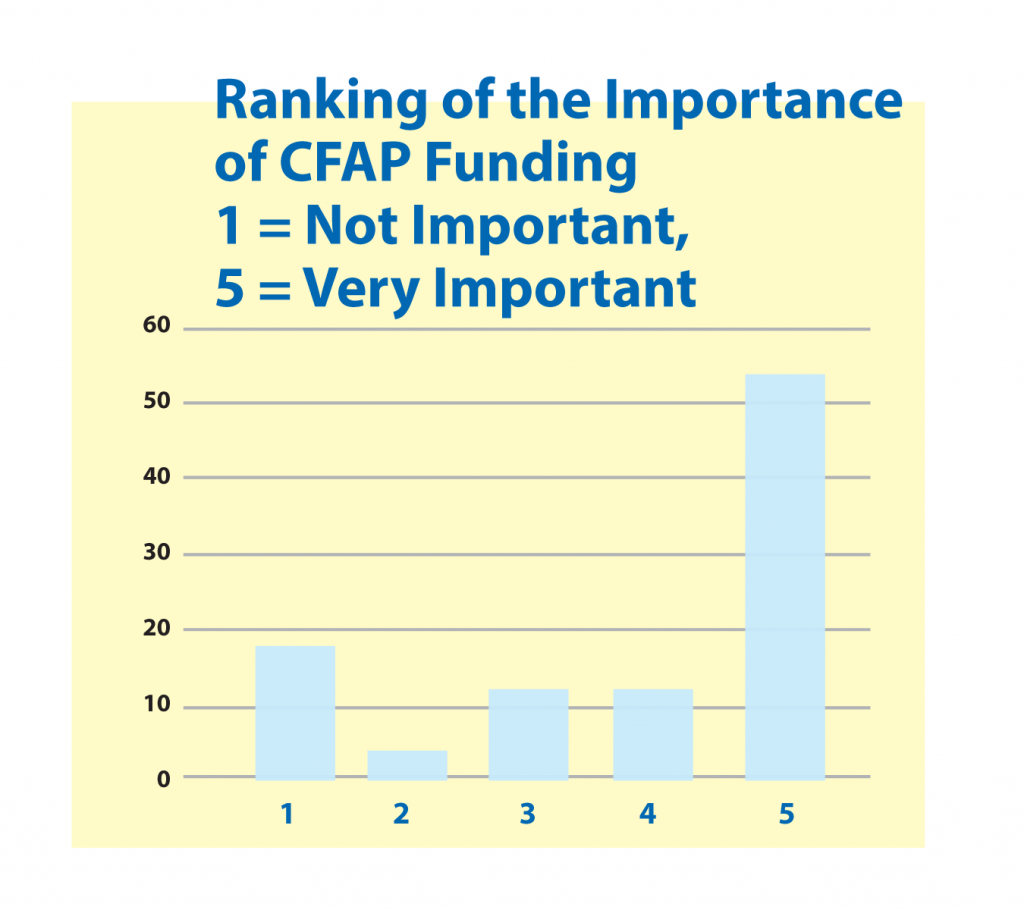

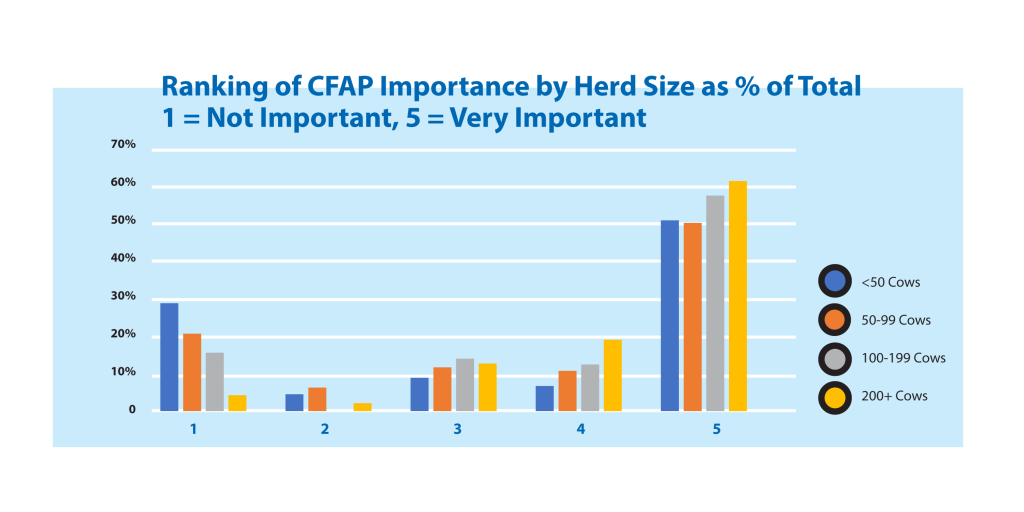

Those who dumped milk were asked if they had received any reimbursement for dumped milk. Only 60 dairies reported dumping milk and only 22 of those answered that they had received any compensation for the dumped milk. The second part of that question was to provide the average value of the compensation, of which there were not enough answers to analyze. The last question related to COVID-19 compensation asked to rate the importance of USDA’s Coronavirus Food Assistance Payments (CFAP) in mitigating market disruptions.

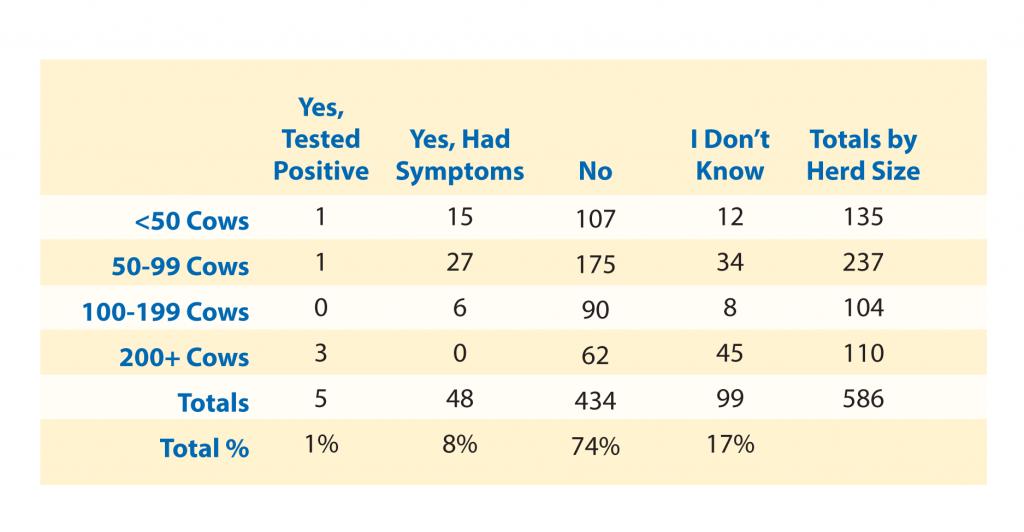

Emergency Plans and COVID-19 Infections

With the potential that employees or key members of the management team may be forced to quarantine due to positive diagnosis or exposure to a person that was positive for COVID-19 and not able to work, dairy farmers were asked if they had implemented an emergency plan.

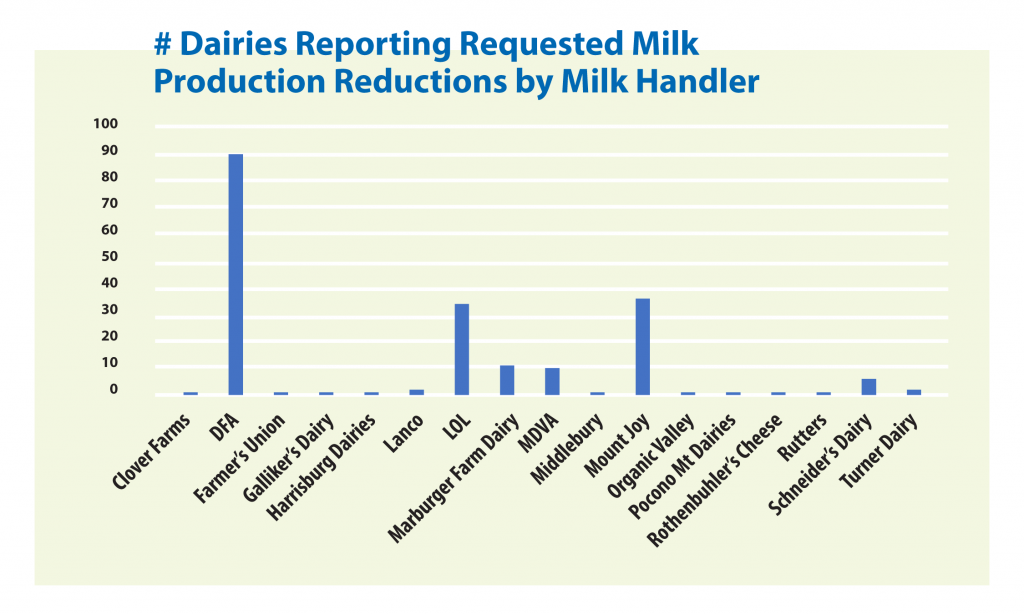

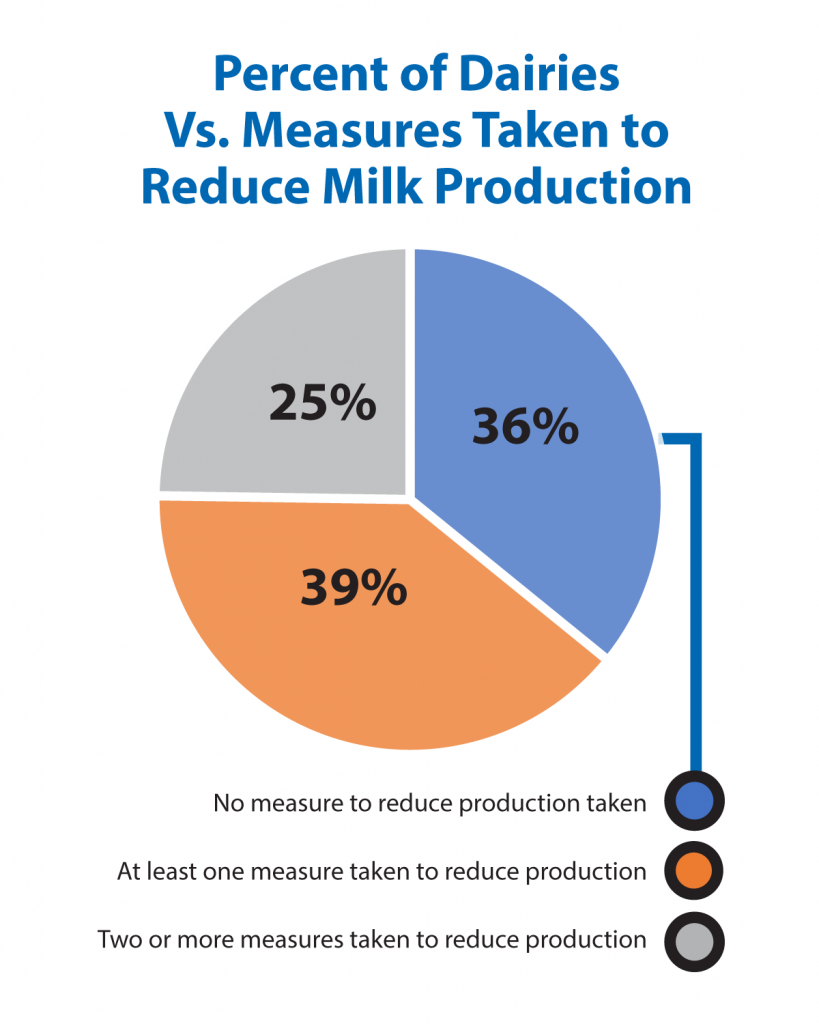

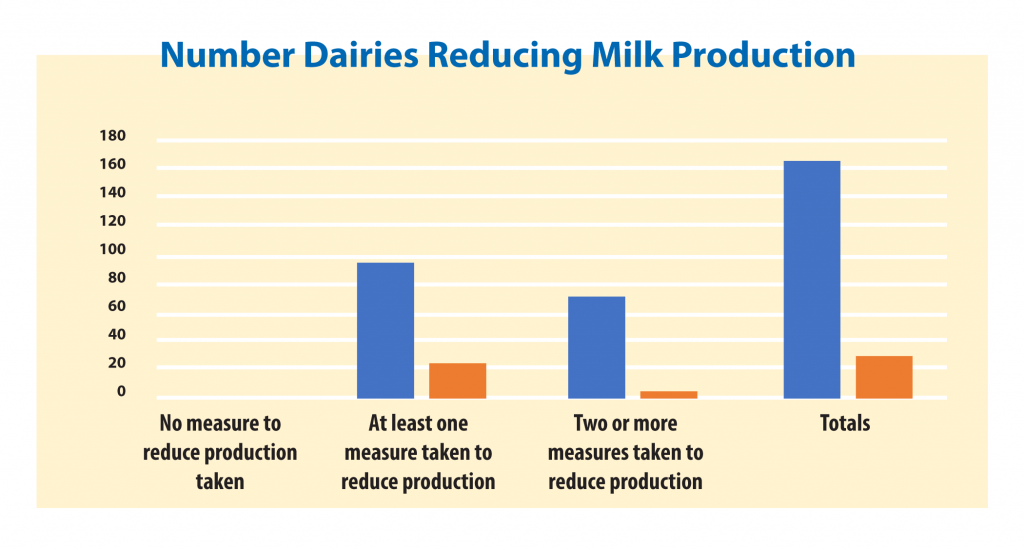

Milk Reductions by Milk Handlers

Survey respondents were asked if their cooperative or milk handler requested them to reduce their milk supply, and if they had taken any measures to reduce milk production. Dairy farms representing 36 cooperatives or milk marketers completed this section of which 17 different milk handlers had, according to the survey participants, requested its members/customers to reduce milk production during the initial months of the COVID-19 pandemic.

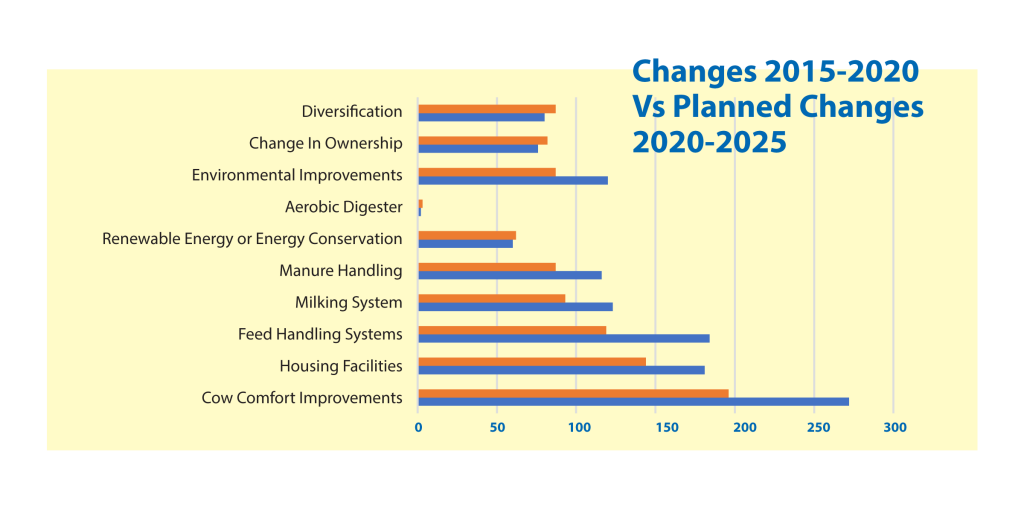

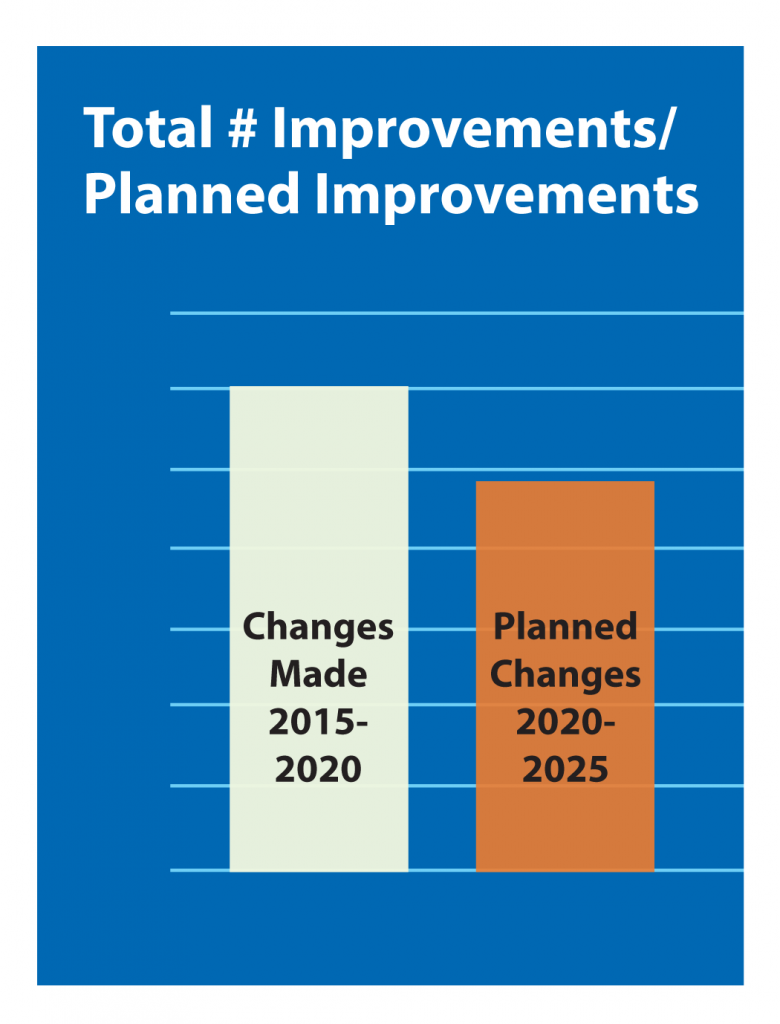

Investments Made in the Last Five Years and Investments Planned for the Next Five Years

The next series of questions was intended to assess what improvements or investments were made in the last five years and if plans existed to further invest in or modifying dairies in the next five years. When asked if changes had been made over the last five years, 354 surveys indicated that an investment had been made in facility changes.

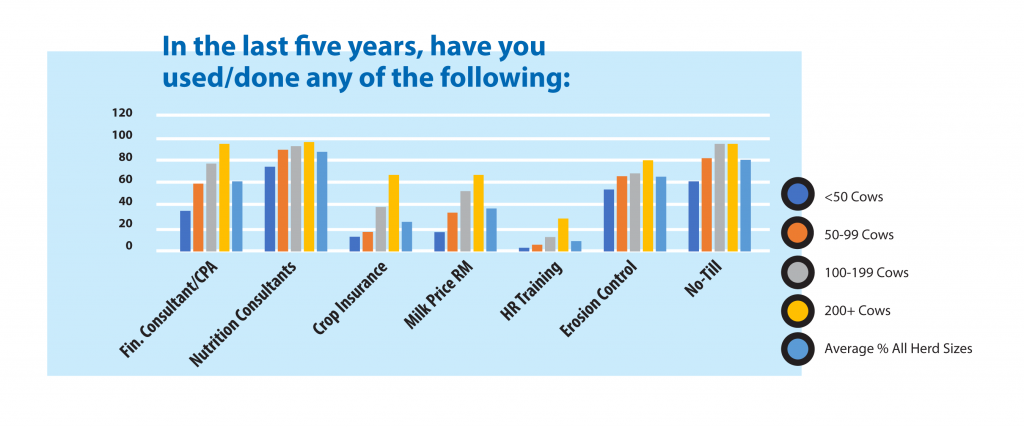

Use of Consultants, Risk Management, Conservation Practices

The next series of questions was asked to help understand the prevalence of using dairy financial and nutrition consultants, crop and milk price related risk management tools, human resource (HR) education, and certain conservation practices.

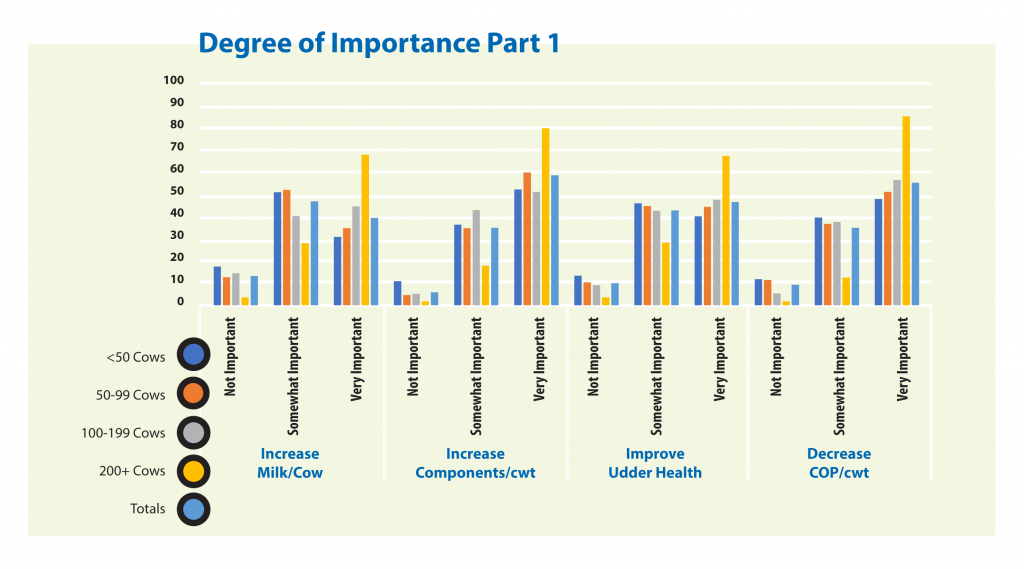

How important are certain factors to performance in the next 3 -5 years?

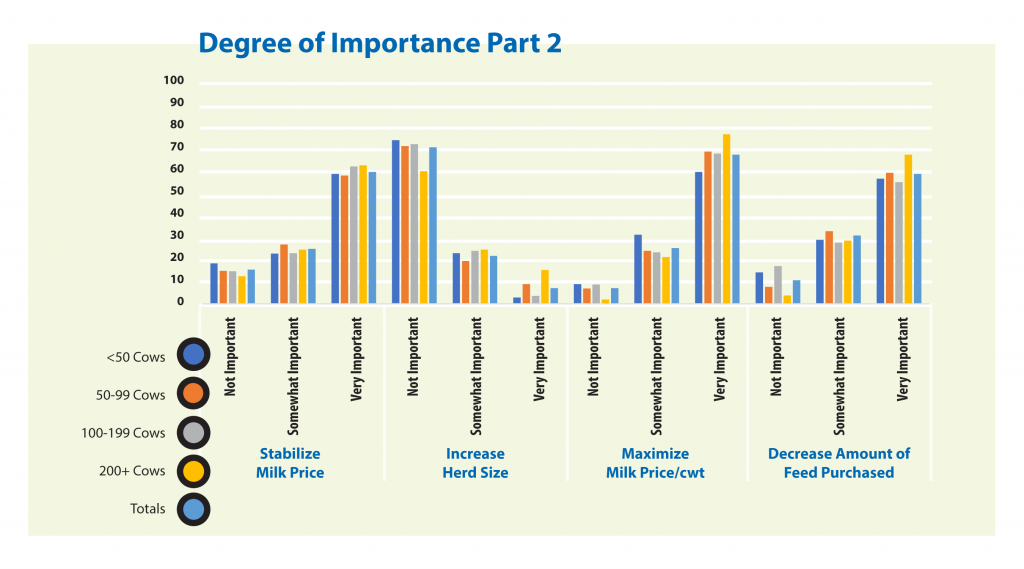

The next survey question asked how important certain factors were to each dairy’s performance for the next three to five years. Dairy farmers were asked to use a scale of one to three to rate the importance of each factor with 1 = Not Important, 2 = Somewhat Important, and 3 = Very Important. Eight different factors were provided to be ranked.

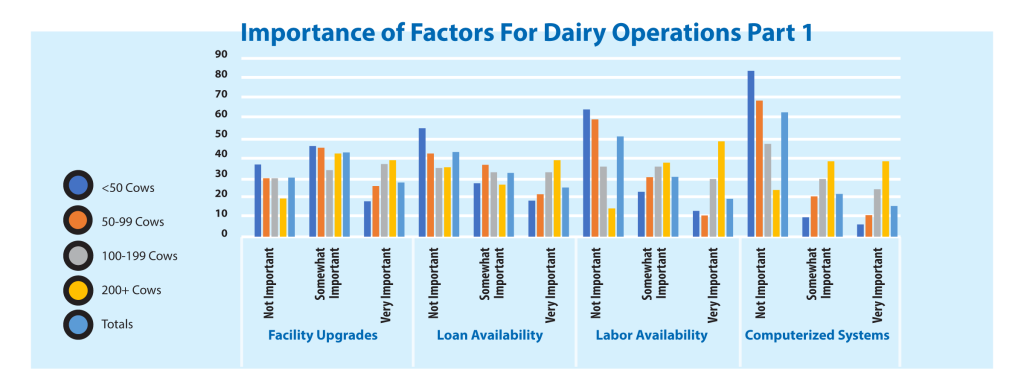

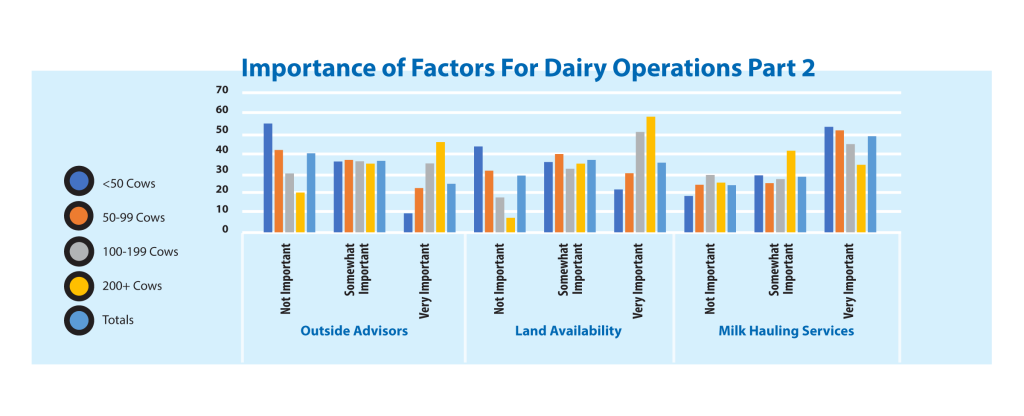

Importance rating of factors needed for dairy operations

Survey participants were asked to rate their importance for facility upgrades, loan availability, labor availability, computerized systems, outside advisors, land availability, and milk hauling services needed for their operations. They were asked to use the same scale as described previously. Importance of the afore mentioned factors were mixed.

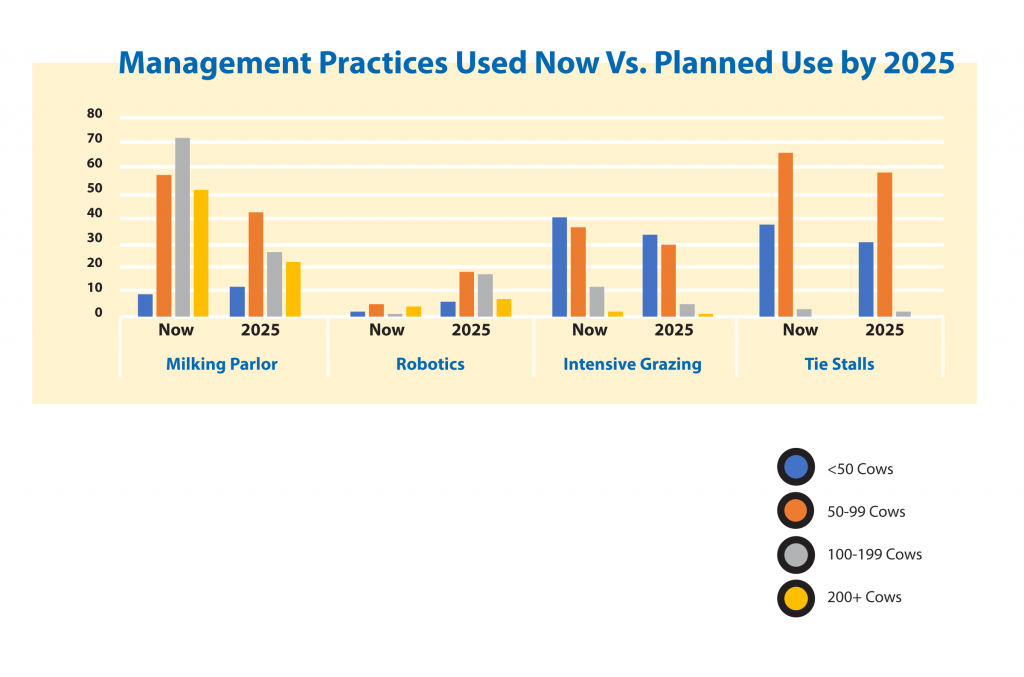

Management practices currently used or expecting to use by 2025

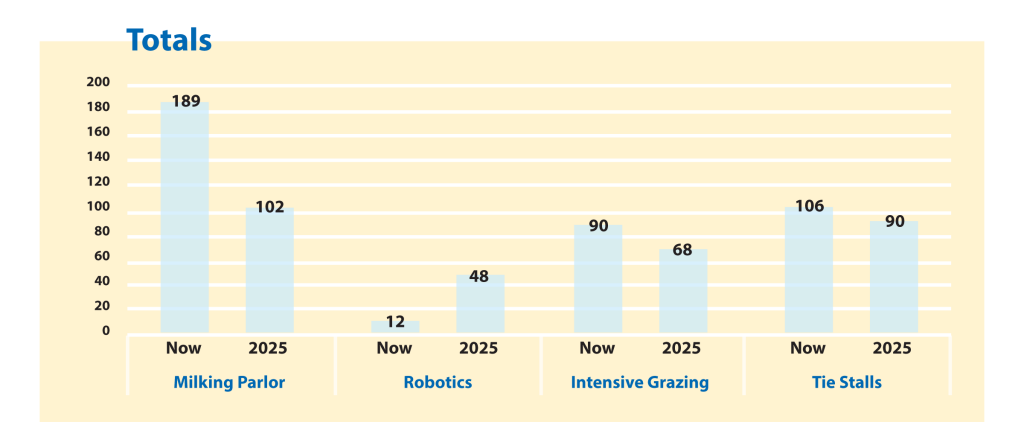

Dairy farmers were asked to indicate if they currently milk in a parlor, use robotics, practice intensive grazing, or house cows in Tie stalls. They were also asked to indicate if they expect to be using them in 2025.

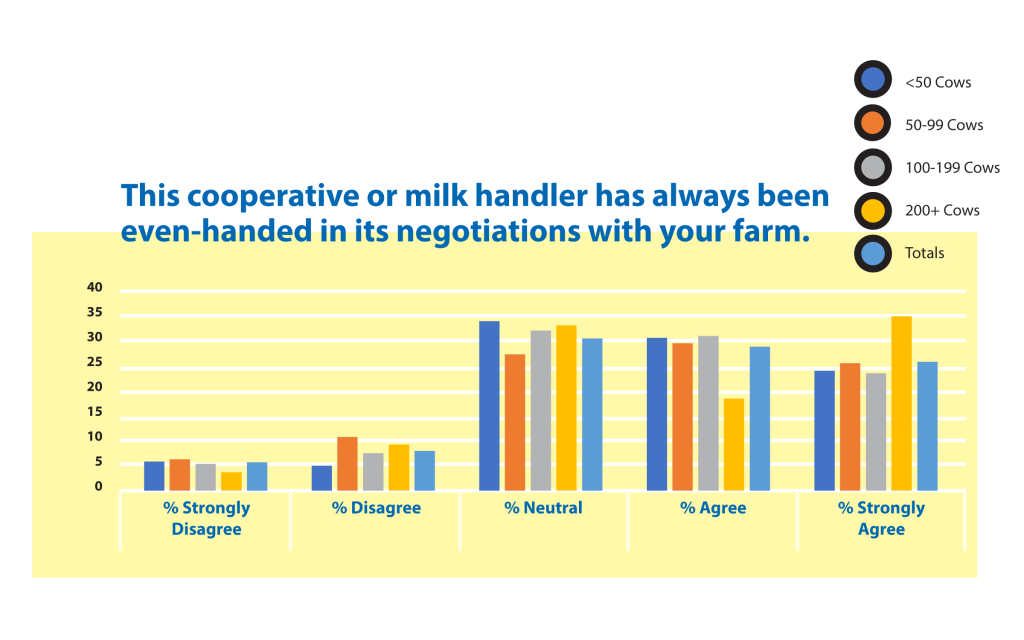

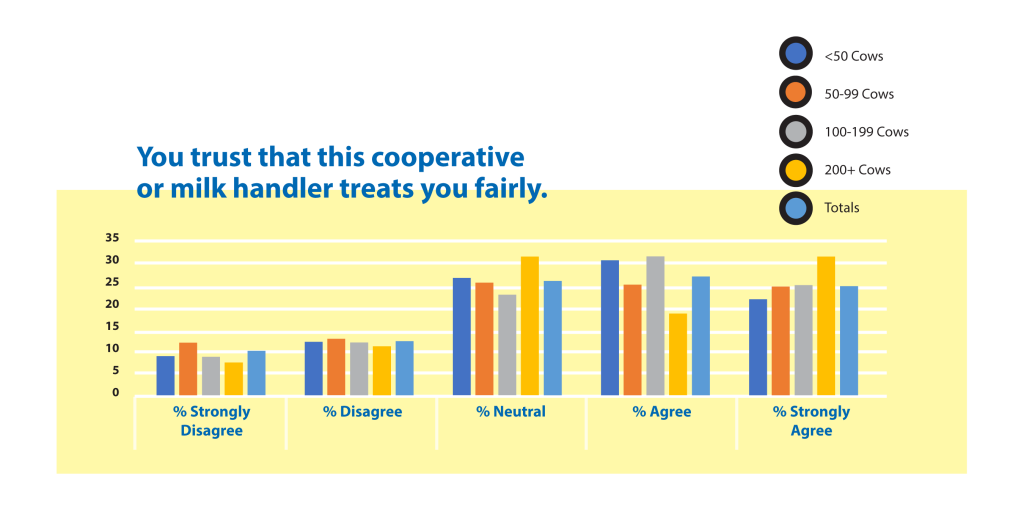

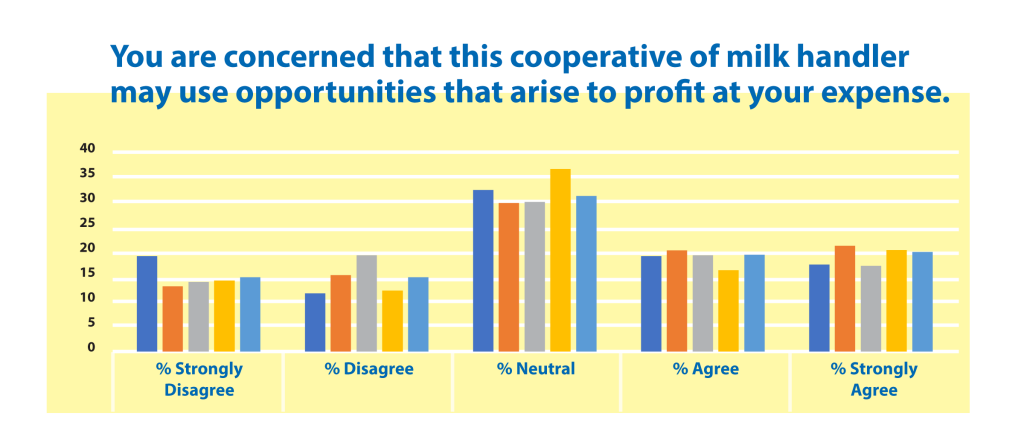

Cooperative or Milk Handler/Buyer Trust

To address the opinion of dairy producers towards their milk handlers, the last section of the survey asked participants to identify how strongly they agree or disagree with the following statements:

1. This cooperative or milk handler has always been even-handed in its negotiations with your farm.

2. You trust that this cooperative or milk handler treats you fairly.

3. You are concerned that this cooperative or milk handler may use opportunities that arise to profit at your expense.

Closing

Surveys were accepted through July of 2020, putting the deadline prior to the second outbreak of the COVID-19 pandemic. Survey responses are only indicative of the effects of the pandemic on dairy farmers during that period. At the time the survey was sent out, the fear was present that there would be a second wave of the COVID-19 pandemic, but it had not been realized yet. As 2020 progressed after the timing of the survey, market disruptions continued, and milk price volatility remained high. A second round of CFAP payments was announced and implemented and became an even more important source of income for those who chose to receive the payments. Also, negative producer price differentials (PPDs) began in June and stayed negative most of the remainder of the year. Perhaps some of the survey answers would have been different if the timing of the survey were delayed. However, results of the survey are relevant and can be used by the dairy industry to identify key areas to be addressed.