COVID-19 is impacting the entire economy and marketplace, including the milk market. We’ll be providing weekly updates with milk futures prices and other market updates to help keep you as knowledgeable as possible during this time. View the entire list of weekly updates.

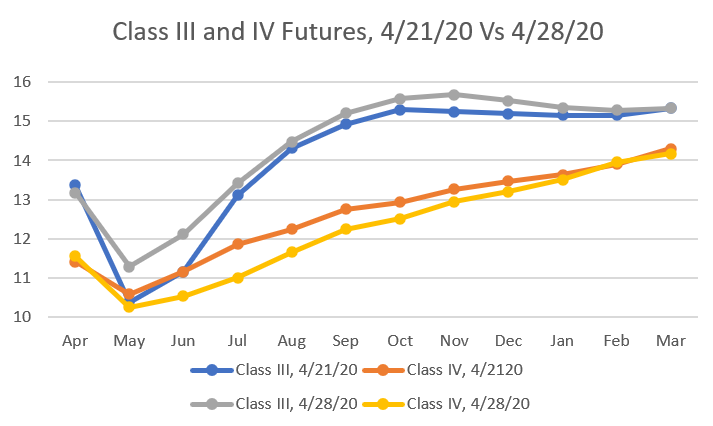

Average Class III price as of April 28, 2020 for the next 12 months has rebounded slightly compared to last Tuesday. The Class III price at the close of markets today is $14.37. This is $0.31 higher than last Tuesday’s $14.06/cwt. Most nearby months continue to decline but gains in May and the months going into fall and the first of next year make up of for the other months to increase the overall 12-month average compared to one week ago. Average Class IV price was lower than last Tuesday. Average Class IV prices for the next 12 months decreased an additional $0.34 to average $12.29/cwt.

A few details have been released about the direct payments that dairy farmers are to receive in late May or early June. These details are not final and are subject to change when final rules are released. Right now, the USDA is planning on making a direct payment to dairy farmers based on the actual loss in milk price as a result of COVID-19 for January 1, 2020 through September 30, 2020. 85% of the loss in price will be paid to dairy farmers for January 1 to April 15. 30% of actual loss will be paid to dairy farmers for April 16 to September 30, 2020. More details will be forthcoming.

The Center has received several questions about the Families First Coronavirus Response Act (FFCRA) passed earlier this year. The questions revolve around whether agriculture is subject to FFCRA. Yes, agriculture operations, including dairy farms must provide the mandatory benefits outlined by FFCRA. This Act makes it mandatory for employers with less than 500 employees to offer paid sick leave and paid family leave if an employee must be absent from work because he/she has COVID-19 or must miss work to provide care for an ill family member with COVID-19. Employers who must provide these benefits will receive a tax refund for the same amount as paid to the employee. Credit is refundable and offsets the employer’s portion of the social security tax when filing quarterly taxes.

View more information on FFCRA.