COVID-19 is impacting the entire economy and marketplace, including the milk market. We’ll be providing weekly/monthly updates with milk futures prices and other market updates to help keep you as knowledgeable as possible during this time.

To learn more about using risk management to protect your profits, contact Zach Myers.

August 17, 2020 Update

August, September, and October Class III prices have declined considerably over the last couple weeks. However, prices from November 2020 through July 2021 seem to have moderated and are trading similarly to slightly higher compared to what they were one month ago. Class III price over the next three months declined an average of $2.23 per cwt since this time last month to $18.11. However, the following 9 months averages $16.57, eight cents per cwt better than one month ago. The Class III milk futures price averages $16.96 for the next 12 months.

July 17, 2020 Update

Class III milk prices over the last month have continued to increase, with the main increases coming between July and November. Class III milk price averages $20.53 per cwt over this five-month period and then averages $16.36 per cwt the following seven months. The 12-month average Class III price is $18.10. In mid-June, the average 12-month price was $17.47. There is a consensus among buyers that there is currently a shortage in the milk supply, and that seems to be the current driver for increased milk prices over the next several months.

June 19, 2020 Update

Earlier this week, Governor Tom Wolf announced that the Commonwealth will be providing $40 million of federal relief money it received from the CARES Act stimulus package signed into law on March 27 to help the Pennsylvania agriculture community in recouping lost revenue due to COVID-19. His administration is allocated $15 million in funds to address losses sustained by dairy farmers across Pennsylvania that were affected by displaced or dumped milk.

June 12, 2020 Update

For the first time in about a month, Class III milk futures average price for the next 12 months declined relative to the previous week. Average Class III price as of 2 p.m. on Friday, June 12, 2020 was $16.84 per cwt, a decline of $0.16 from last week’s $17.00. Class IV notched a slight $0.07 per cwt increase over last Friday. Today’s average price for the next 12 months is $15.80, up from $15.73 last week.

June 5, 2020 Update

Class III and IV milk futures continued their upward trend this week with June Class III closing at $20.21 on Thursday, June 4. As of 1:30 p.m. June 5, the Class III and IV markets are off a little compared to yesterday, but the 12-month average is much improved compared to last Friday, May, 29. The Class III 12-month average is $17.00 per cwt, up 70 cents from last Friday.

May 29, 2020 Update

This week showed more improvement in the average Class III and IV milk futures prices compared to last week. As of 2 p.m. on Friday, May 29, average Class III milk futures for the next 12 months was $16.30 per cwt, up $0.46 from $15.84 on Friday, May 22. Class IV average price was up $0.36 from last Friday to $14.82.

May 22, 2020 Update

After decent gains were posted at the end of last week, some of those gains were reversed this week with average Class III and IV prices on Friday, May 22 as of 3:00 p.m. losing ground compared to last Friday’s futures prices. Average Class III price for the next 12 weeks is $15.84, down $0.32 from last week’s $16.16 per cwt. Class IV average for the next 12 months is $14.46 per cwt, down only $0.09 per cwt compared to last week’s $14.55.

May 15, 2020 Update

Class III and Class IV milk futures as of noon on Friday, May 15, 2020 are significantly improved from a week ago. Hopefully, this is the beginning of a market correction from the huge disruption caused by COVID-19 beginning in March. Average Class III price for the next 12 months climbed from $15.09 per cwt last Friday to $16.16 today.

May 12, 2020 Update

Class III and IV Milk futures began this week where they left off last week, posting decent gains in most months for the next 12 months. As of 4:45 p.m. on Tuesday, May 12, the average Class III price over the next 12 months is up $0.43 per cwt to $15.52 driven by gains in June through December compared to last Friday, May 8. Average Class IV price increased $0.40 per cwt to $13.35 compared to last Friday. Hopefully, these gains will continue through the week.

May 8, 2020 Update

Average Class III price over the next 12 months is down as of 2 p.m. on May 8 relative to prices on Tuesday. However, it is up compared to closing prices on last Friday, May 1. Class III price for the next 12 months averages $15.09/cwt, up 41 cents from last Friday’s $14.68. Class IV average price continues to experience gains over the next 12 months compared to last Friday. Class IV price for the next 12 months averages $12.95/cwt and is also up 41 cents from last Friday’s $12.54. Class IV price is up 15 cents compared to Tuesday’s average price.

May 5, 2020 Update

Class III and IV prices continue to improve relative to last Friday. As of 1 p.m. on Tuesday, May 5, the 12-month Class III average is up $0.63 to $15.31 per cwt compared to Friday, May 1. Average 12-month Class IV price has increased $0.26 to $12.54 per cwt. This is a short period of time to think that markets are rebounding, but it is at least encouraging that Class III prices, on average, have increased for the last two weeks and Class IV for the last week. Hopefully, current trends will continue as states across the nation begin to slowly reopen their economies this month.

May 1, 2020 Update

Class III and IV prices have improved slightly since Tuesday’s market update. Average Class III price over the next 12 months has improved $0.31 to $14.68/cwt since Tuesday with most of the gains coming in the later months. Average Class IV price over the next 12 months has improved $0.25 to $12.54/cwt. Gains in Class IV are spread out through the next 12 months and not a specific set of months.

April 28, 2020 Update

Average Class III price as of April 28, 2020 for the next 12 months has rebounded slightly compared to last Tuesday. The Class III price at the close of markets today is $14.37. This is $0.31 higher than last Tuesday’s $14.06/cwt. Most nearby months continue to decline but gains in May and the months going into fall and the first of next year make up of for the other months to increase the overall 12-month average compared to one week ago.

April 24, 2020 Update

This week both the Senate and House passed a $484 billion stimulus package that provides additional funding to two of the Small Business Administration’s (SBA) disaster relief loans. The bill provides about $320 billion in funding to the Paycheck Protection Program (PPP) and an additional $60 billion to the Economic Injury Disaster Loan (EIDL) program. About $75 billion will go to support hospitals, and the remaining $25 billion will be used will for coronavirus testing.

April 22, 2020 Update

Class III futures continue to erode further with the average price over the next 12 months declining another 35 cent/cwt from last Tuesday. However, the average Class IV price has increased slightly to $12.63/cwt, up 13 cents from last Tuesday. Volatility and uncertainty about COVID-19 has continued to impact dairy markets negatively. In a conference call on Monday, April 20, 2020, Greg Ibach, USDA Under Secretary of Agriculture, said the economic impact to total agriculture are in excess of $40 billion. On the same conference call, The Under Secretary gave initial details on how the $19 billion Coronavirus Food Assistance Program (CFAP) stimulus package announced by the administration and USDA late last week will be spent.

April 15, 2020 Update

Class III and IV milk futures have continued to deteriorate compared to last Thursday’s closing prices. Average Class III price fell an additional $0.37 for the next 12 months to $14.41. Average Class IV price for the next 12 months fell an additional $0.09 to $12.50. There has been no additional information provided as to how USDA plans to use the funds provided by the Coronavirus Aid, Relief, and Economic Security (CARES) Act. $23.5 billion dollars from the CARES Act has been allocated specifically for use by the USDA to provide economic relief to agriculture. There is one program created by the CARES Act that is available now: the Paycheck Protection Program (PPP).

April 10, 2020 Update

The Class III and IV milk futures prices for the next 12 months showed marginal improvement compared to the end of last week. Unfortunately, both Class III and IV markets at the end of closing on April 9, 2020 in the near months continued a downward trend and are below week ago prices. However, gains in the following months brought the average 12-month price up compared to last week.

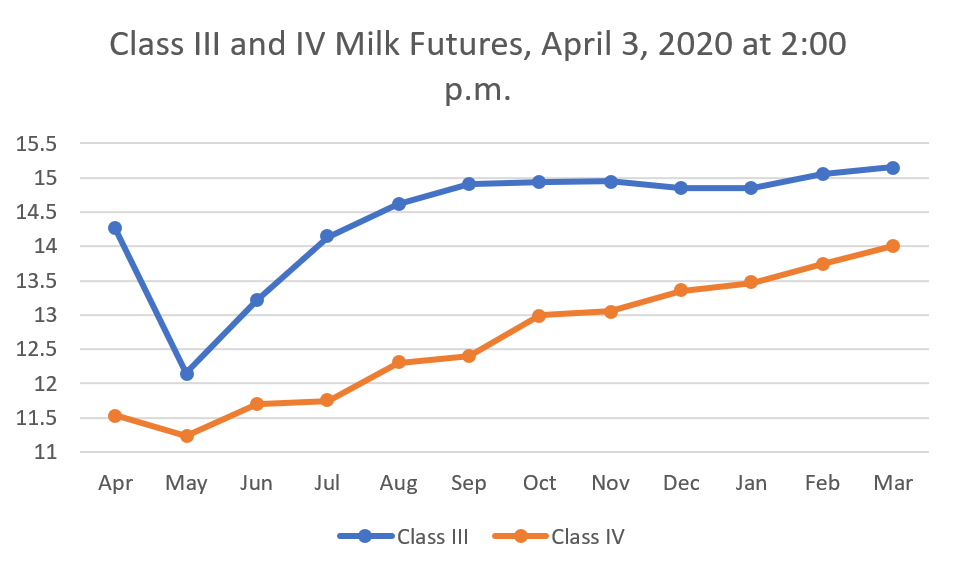

April 3, 2020 Update

After posting brief gains earlier this week, Class III and IV have since declined even more as a result of extreme market volatility caused by COVID-19. Both Class III and IV average prices for the next 12 months are down compared to last week. Average Class III price as of 2 p.m. on Friday, April 3, 2020 was $14.42, $0.99 less than last Friday, March 27. Average Class IV prices for the next 12 months are $12.63, $1.43 less than last Friday.

COVID-19 cases in the U.S. continue to increase and are expected to peak sometime in April or May for most states, if stay-at-home and social distancing orders are strictly observed. However, new cases are predicted to continue into the summertime according to the University of Washington’s Institute for Health Metrics and Evaluation. Please follow all stay-at-home and social distancing guidelines to the best of your ability. Agriculture is considered essential business, but dairy farmers and their employees can still observe social distancing guidelines and other measures to limit the risk of exposure. You can find guidelines for you and your employees here. Both English and Spanish versions are available.

There continues to be reports of dumped milk across the region. As mentioned in the last market update, farmers will hopefully be compensated for any milk that must be dumped. If you must dump milk, record the volume and report it to your cooperative or milk marketing company so they can report it to the Federal Milk Marketing Order. In order to receive payment for dumped milk, it must be reported.

According to American Dairy Association Northeast, retail stores across the Northeast have adjusted to the recent surge in demand for dairy products and in numerous stores, have lifted purchasing limits for milk and other dairy products. ADANE asks that if you are at a retailer that still has purchasing limits or out-of-stock dairy cases, take a picture, note the location and time, and email Beth Meyer so ADANE can follow up with that retailer.

April 1, 2020 Update

There has been a lot of confusion and frustration this week surrounding empty dairy cases, with purchase limits for dairy products at grocery stores and simultaneous reports of milk being dumped in parts of the country. While it can be frustrating, there is a valid explanation. Prior to COVID-19, food service establishments were by far the largest user of manufactured dairy products like cheese and butter. With restaurants closing or offering limited service coupled with travel and work restrictions and more people eating at home, food service sales have experienced drastic declines in sales. Market data prior to the COVID-19 pandemic indicated that over 50% of meals in the U.S. were consumed away from home. However, recent sales data indicates that fluid milk sales have increased over 30% compared to the same time period last year.

Unfortunately, the increase in fluid milk sales has not offset the lost sales of manufactured dairy products from food service outlets. It takes time for processors to adjust to the drastic changes in demand like what has occurred in the last month or so. Likewise, it takes time for stores to modify ordering strategies to account for drastic changes in demand. Stores are trying to figure out how much of each dairy product they need to maintain stock. At the same time, processors do not have the sales to clear their current inventories. They have also seen increasing milk supplies because we are in the middle of the spring flush. All these factors are creating a huge imbalance in normal supply and demand. While processors can more easily bottle additional fluid milk, they are not able to continue producing the same volume of manufactured products. The result is milk that has no home and must be dumped. The USDA has announced that dairy farmers will receive some form of relief for dumped milk, but no details are yet available. View the March 25, 2020 USDA letter to learn more.

In the case you must dump milk, Penn State Extension explains that milk can be land applied and has more fertilizer value than manure alone. Learn more about land applying waste milk. Any dumped milk should be measured, recorded and reported to your cooperative or milk marketing company.

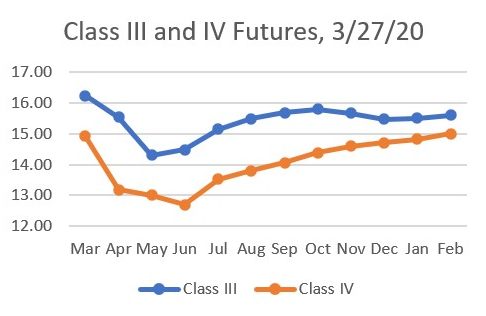

March 27, 2020 Update

Despite the overall rally in the stock market over the last few days, Class III and IV milk futures continue to slide. Average Class III futures for the next 12 months is down to $15.41 as of 9:30 a.m. on Friday, March 27. It has fallen an additional 51 cents from $15.92 at the close of business on Monday, March 23. Average Class IV futures did not fall quite as steeply, but still fell 35 cents to $14.06 for the next 12 months compared to $14.41 last Monday.

The Senate unanimously passed a $2 trillion stimulus package late Wednesday. The legislation includes $23.5 billion dollars earmarked for agriculture, including $9.5 billion in emergency funding and $14 billion to replenish the Commodity Credit Corporation which will reauthorize the Market Facilitation Program (MFP). MFP provided three direct payments in 2019 and early 2020 to dairy farmers that were equal to $0.20 per hundredweight of Dairy Margin Coverage (DMC) Production History. The House of Representatives was set to start debating this stimulus package or creating their own this morning. There are currently no details on how the money for agriculture would be distributed.

Yesterday, Pennsylvania Secretary of Agriculture, Russell Redding, sent a letter of support to USDA Secretary Sonny Perdue for reopening enrollment for Dairy Margin Coverage. Only 34% of U.S. dairies enrolled in DMC during the original 2020 enrollment period and only 14% of Pennsylvania dairies enrolled. If the DMC projected margins calculated on March 26, 2020 were to become reality, it would mean a net payment of around $7,500 per 1 million pounds of production history enrolled after the premium is deducted for 2020. Projected margins are below the $9.50 trigger starting in March and continuing through December, with June margins the lowest at $7.23.

March 24, 2020 Update

At the end of December and going into January, this year was looking like it would be a decent year, pricewise. Then the COVID-19 pandemic came and has since wreaked havoc on all markets, including the milk market. Class III milk futures over the next 12 months have decreased to $15.92 as of the close of trading on March 23, 2020. This is $1.98 lower than January’s high of $17.90. The Class IV 12-month average has suffered even worse declines. Class IV for the next 12 months now averages $14.91 when at the end of January, it averaged $17.94. This is a $3.03 drop in two months. The current market underscores why risk management is so important in today’s dairy industry. No one could have predicted three months ago that a virus would throw a huge monkey wrench into the dairy economy when the markets were looking like a relatively profitable milk price for most of 2020.

As a result of how good 2020 milk price looked towards the end of 2019, not many dairy farmers across the country took advantage of the Dairy Margin Coverage (DMC) program. Projected margins at the end of 2019 did not come anywhere close to the highest DMC margin of $9.50 and a lot of farmers elected not to participate. Based on current market projections, DMC margins fall below the $9.50 trigger this month and remain under through October. The March DMC margin will not be announced until the end of April. Right now, there is an 82% probability that the actual margin will be below the $9.50 trigger. Currently, some dairy industry groups are requesting that the USDA re-open enrollment for the 2020 DMC program year. There is certainly no guarantee that this will happen. If it does, we will be posting it here, so keep checking this section for the latest news.