COVID-19 is impacting the entire economy and marketplace, including the milk market. We’ll be providing weekly updates with milk futures prices and other market updates to help keep you as knowledgeable as possible during this time. View the entire list of weekly updates.

Class III and IV Milk Futures

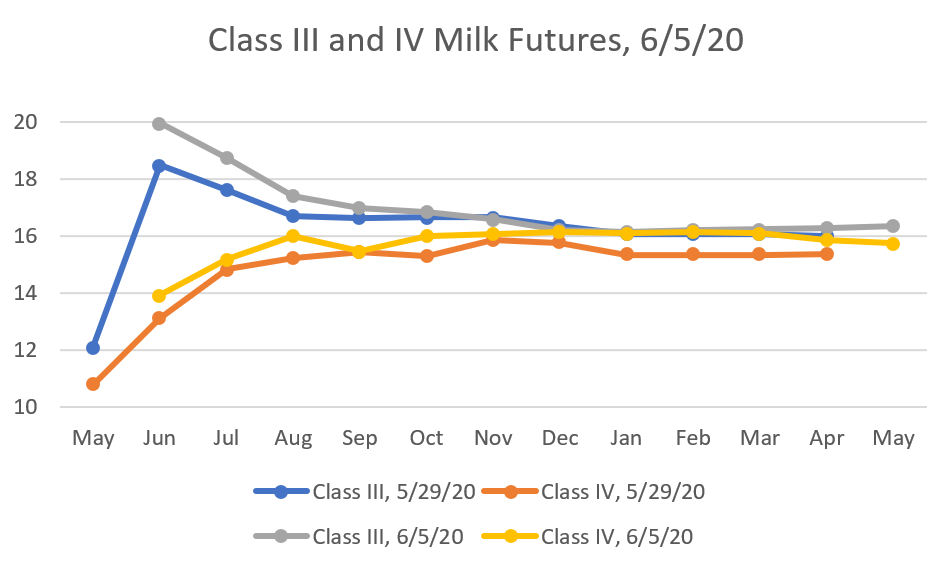

Class III and IV milk futures continued their upward trend this week with June Class III closing at $20.21 on Thursday, June 4. As of 1:30 p.m. June 5, the Class III and IV markets are off a little compared to yesterday, but the 12-month average is much improved compared to last Friday, May, 29. The Class III 12-month average is $17.00 per cwt, up 70 cents from last Friday. The average Class IV price averages $15.73 over the next 12 months, up 91 cents from last Friday. The Class III price increase is driven by increased demand for cheese, and Class IV price increase is being driven by increased demand for butter and powder.

In Export News

Chinese imports of U.S. dairy in April surpassed expectations. Imports of whey increased 15%, which represent the third consecutive month of growth. Imports of whole milk powder and infant formula were up 22% and 10, respectively. However, cheese imports and skim milk powder imports were down, 11% and 4%, respectively.

Last week Vietnam agreed to lower tariffs on imports of dairy products from the U.S. The lower tariff rates will allow the U.S. to better compete with New Zealand and Australia who have free trade agreements with Vietnam. The new tariff rates will start on July 10, 2020. Vietnam has a population of about 96 million people and represents a great opportunity for sales of U.S. dairy products.

The U.S. is expected to start free trade agreement negotiations with several countries this year. The most notable countries include Phase 2 with China and Japan, United Kingdom, European Union, Kenya, Ecuador, and possibly New Zealand and Switzerland.