COVID-19 is impacting the entire economy and marketplace, including the milk market. We’ll be providing weekly updates with milk futures prices and other market updates to help keep you as knowledgeable as possible during this time. View the entire list of weekly updates.

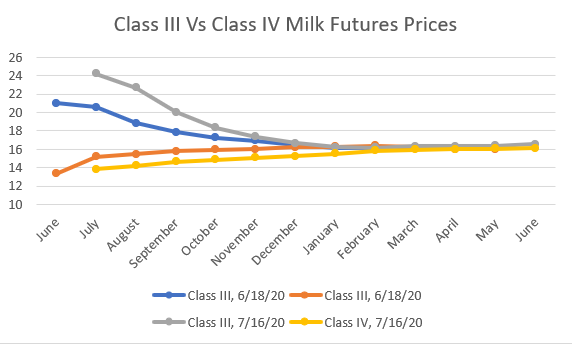

Class III milk prices over the last month have continued to increase, with the main increases coming between July and November. Class III milk price averages $20.53 per cwt over this five-month period and then averages $16.36 per cwt the following seven months. The 12-month average Class III price is $18.10. In mid-June, the average 12-month price was $17.47. There is a consensus among buyers that there is currently a shortage in the milk supply, and that seems to be the current driver for increased milk prices over the next several months.

Unfortunately, Class IV milk prices have dropped since mid-June. Class IV milk prices are generally down across all months compared to this time last month. The current 12-month average is $15.28 per cwt, down 45 cents per cwt from mid-June’s $15.73. There is a lot of butter and powder on the market right now keeping downward pressure on Class IV.

May dairy exports were the highest in over two years, driven by record powder exports and increased cheese sales. U.S. suppliers shipped 210,429 tons of milk powders, cheese, whey products, lactose, and butterfat, according to the U.S. Dairy Export Council. This is 18% higher than last year and exports on a solids basis were also up 18% compared to last May. Perhaps low Class IV milk price kept international markets interested in U.S. products, contributing to record powder exports.